[ad_1]

To print this article, all you need is to be registered or login on Mondaq.com.

Mexico is the second largest economy in Latin America and is

growing at an astonishing rate. Despite a slight deceleration in growth in

2018, mostly triggered by a struggle to recover from the

earthquakes in September 2017 that shook, economically and

physically, the capital to its core, Mexico is comfortably one of

the most influential economies in the world and is estimated to be

the 7th largest global power in the world by 2050.

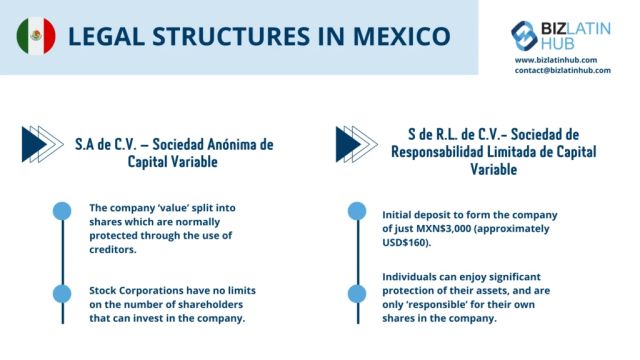

The most popular legal structures in Mexico are: Corporation (S.A),

Sociedad Anónima de Capital Variable (SA de CV), and Limited

Liability Company (S de RL).

In recent years, a number of highly competitive industries have

flourished and have rendered the Mexican market a far more varied,

dynamic and interesting platform for foreign investment than ever

before.

SA de CV & S de RL de CV. Types of Legal structures in

Mexico

One new market that has experienced particular success in recent

years is the emergence of new markets such as the production of

medical equipment and devices. As of 2016, this industry is valued

by ProMexico, the governmental agency responsible for encouraging

foreign investment, at over USD$13 billion.

This same report highlights savings of over 20% when compared to

fabrication in the US. This industry, as typifies all emerging

industries in Mexico, is driven by an incredibly well educated, and

economically accessible workforce. This ‘Holy Trio’ of

innovative industries, cheap fabrication costs and a qualified

workforce can be applied to any of the countless emerging

industries and has been the crucial distinguishing factor between

Mexico and other emerging economies.

The most straightforward way to tap into the goldmine of

opportunities that exist is to incorporate a Mexican

company directly into the local market. The following article

will focus on the 3 most common and most important types of

companies/legal entities that can be formed in Mexico. Keep reading

or go ahead and contact us

now to discuss how we can be of assistance.

These are the types of legal structures in Mexico:

- S.A de C.V. – Sociedad Anónima de

Capital Variable (Stock Corporation) - S de R.L. de C.V.- Sociedad de Responsabilidad

Limitada de Capital Variable (LLC- Limited Liability Company) - SAS- Sociedad por Acciones Simplificada

(Simplified Shares Company)

It is also worth noting that there are two more categories:

- SAPI: Sociedad Anónima Promotora de

Inversión (Stock Corporation for Investment Promotion) - SOFOM: Sociedad Financiera de Objeto

Múltiple (Multi Purpose Financial Company)>

REMEMBER: These final two corporate structures

focus on companies looking to enter the Mexican Stock Exchange

(Bolsa Mexicana de Valores, also referred to as the MexBol or the

BMV). For this reason this article will not go into detail on these

structures. If you have any queries regarding these company types,

do not hesitate to get in touch with our team.

S.A de C.V. – Sociedad

Anónima de Capital Variable (Stock

Corporation)

The key facts for the Stock Corporation and most popular legal

structure in Mexico are:

- The company is formed and the company ‘value’ split

into shares which are normally protected through the use of

creditors. - Stock Corporations have no limits on the number of shareholders

that can invest in the company. This means that raising the

necessary capital (MXN$50,000 – approximately USD$2,700) is

very achievable for new companies as an unlimited number of people

can contribute. - Although this structure includes certain bureaucratic and

administrative burdens, it is undoubtedly the structure that has

the largest potential for growth and profit.

SA de CV. Accounting and taxation in Mexico. Sociedad

Anónima

S de R.L. de C.V.- Sociedad de

Responsabilidad Limitada de Capital Variable (LLC- Limited

Liability Company)

The second most popular typeof legal structures in Mexico is the

Limited Liability Company. It is also based on shares and has the

following distinguishing features:

- An LLC is very accessible for SMEs with an initial deposit to

form the company of just MXN$3,000 (approximately USD$160). - Another advantage is that taxes are paid through individual

members tax return, rather than as a collective company. - Individuals can enjoy significant protection of their assets,

and are only ‘responsible’ for their own shares in the

company, as suggested by the name.

SAS- Sociedad por Acciones

Simplificada (Simplified Shares Company)

The third major legal structure in Mexico is the SAS, which is

mirrored in other Latin America jurisdictions such as Argentina and

Colombia. It is a relatively new concept that was announced in 2016

as part of the reforms to the General Law of Commercial Companies.

The advantage of this structure is clear and stems from the very

reason that this structure was introduced. Mexico is making

significant steps to open up their market for foreign investment,

and have made many reforms to different pieces of commercial

legislation to simplify and encourage foreign operations. The SAS

is a perfect example of this.

Some key characteristics of the Mexican SAS include:

- A relatively cheap, fast and simple formation process and

corporate structure, and is ideal for SMEs looking for an easy

route-to-market. - One potential problem involved with this corporate structure is

the fact that there is an annual maximum permissible profit of

MXN$5,000,000 (approximately USD$265,000). For this reason, the SAS

is preferred amongst SMEs as opposed to multinationals looking to

expand operations.

Steps for LLC formation in Mexico. SA de CV. Sociedad

Anónima

Don’t Forget: It is possible to adjust your

legal entity to have a new corporate structure if your company

reaches a point where it is making profits exceeding this limit of

MXN$5,000,000.

Your specific business objectives and requirements will impact

on the ideal corporate structure for your company. Before jumping

in and incorporating a type of legal structures in Mexico, it is

best to consult with local experts who can guide you towards the

best type of legal structure based on your Mexican operations.

self

Originally published 21 September, 2018 | Updated on: 27

June, 2023

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Corporate/Commercial Law from Mexico

[ad_2]

Source link