[ad_1]

Jan. 2, 2023

Sioux Falls CEOs’ opinions of the national economy hit a low for the year, even as they remain optimistic about their own businesses heading into 2023.

That’s according to the most recent SiouxFalls.Business quarterly CEO survey, conducted in partnership with the Augustana Research Institute.

The latest survey was conducted during mid-December and completed by nearly 70 CEOs and business owners.

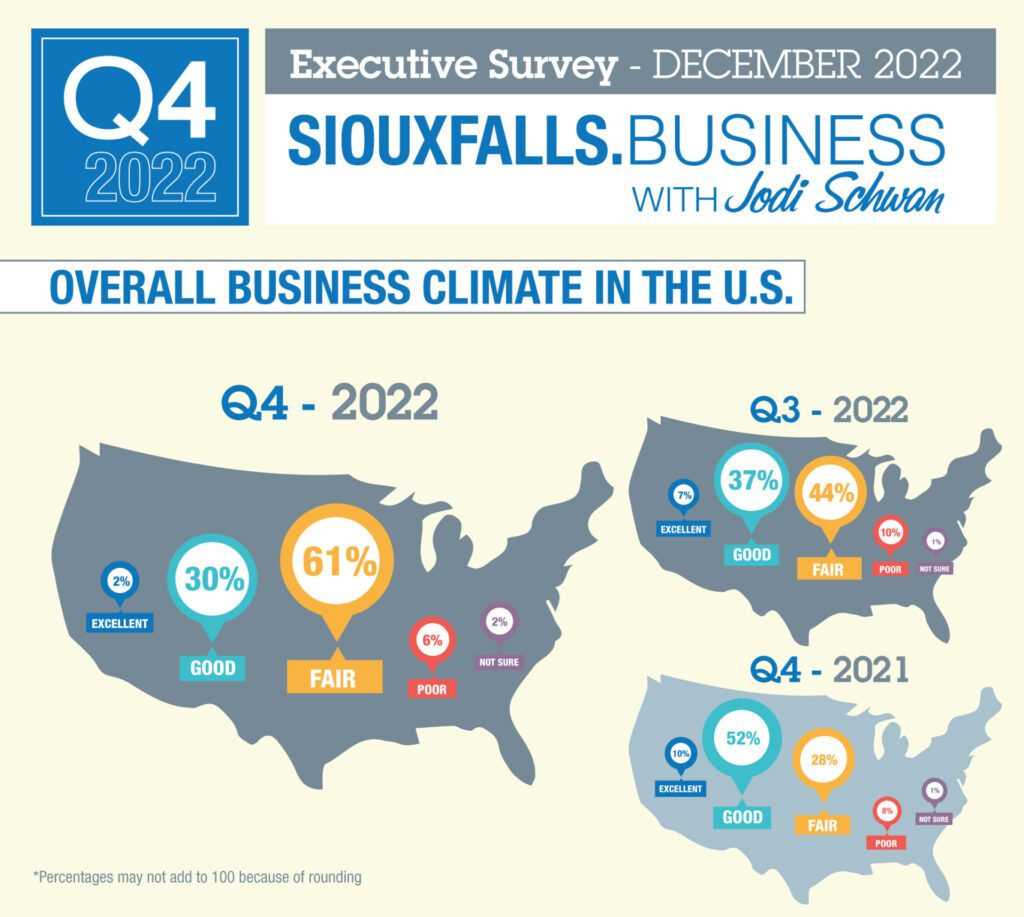

Less than one-third of CEOs described the U.S. business climate as excellent or good, compared with 44 percent three months ago and 62 percent one year ago.

That’s the biggest “big picture” change in the survey, according to Reynold Nesiba, a professor of economics at Augustana University.

“This declining optimism about U.S. business conditions likely reflects global instability caused by Russia’s ongoing war of aggression on Ukraine, a turbulent year on stock and bond markets, as well as persistent inflation and the federal policy responses to counter it,” he said.

Although inflation as measured by the consumer price index has fallen for four straight months, the 7 percent annual rate recorded in November means that prices continue to increase faster than wages, he continued.

“Working people, particularly renters, are feeling the pinch,” Nesiba said. “Perhaps the 32 (percent of survey respondents) who remain optimistic about U.S. business conditions are focusing on tangible good news at the national level?”

The U.S. unemployment rate remains low at 3.7 percent in November.

“Economic growth seems to have bounced back stronger in the third quarter than initially reported,” Nesiba said. “The estimate was revised upward to a stronger 3.2 percent after small declines in GDP during the first and second quarter of 2022. So there are concrete data points that demonstrate resilience and provide a basis for hope.”

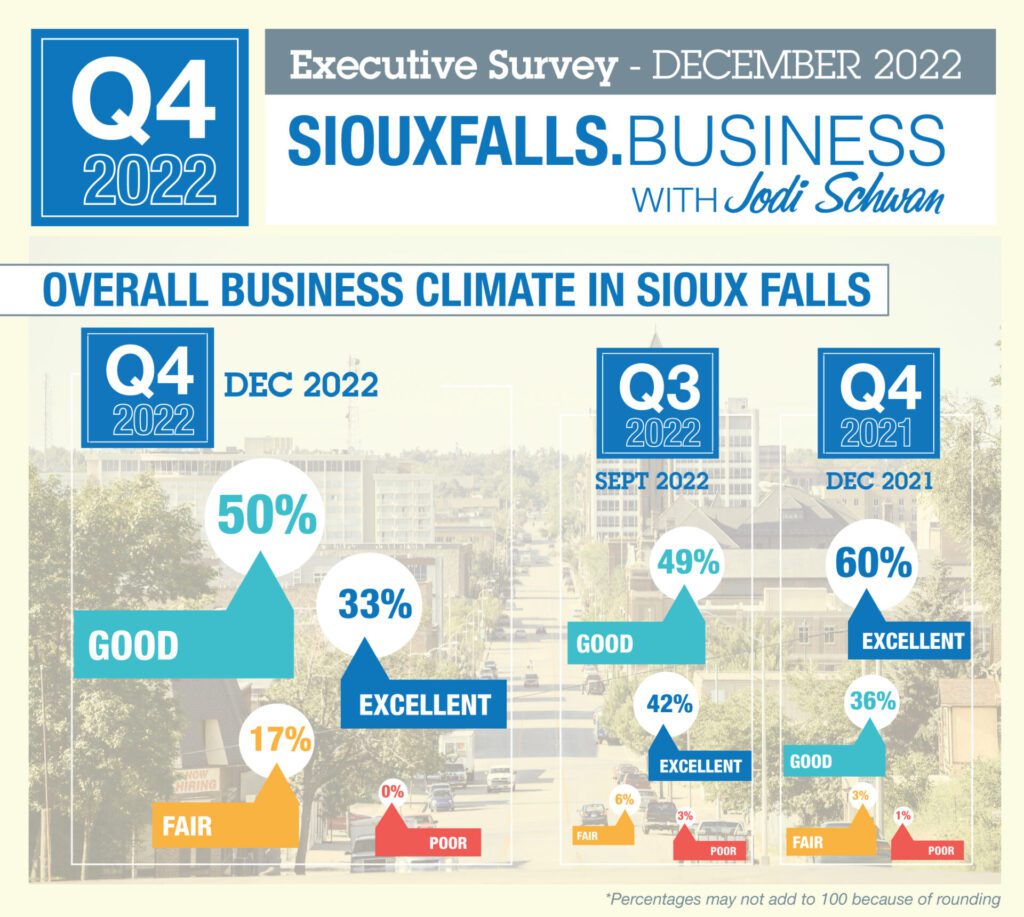

As they traditionally do, CEOs are more positive about the Sioux Falls business climate, with 83 percent rating it good or excellent.

“Despite the disconnect between perceptions of the business climate in Sioux Falls compared to the nation, we do compete and participate in national credit, labor, goods and factor markets,” Nesiba said.

“It is not a surprise that higher interest rates, decreases in federal spending and fears of a national recession are also dampening expectations here in Sioux Falls regarding hiring and investment. That said, overall conditions at respondent businesses, sales activity and hiring remain strong.”

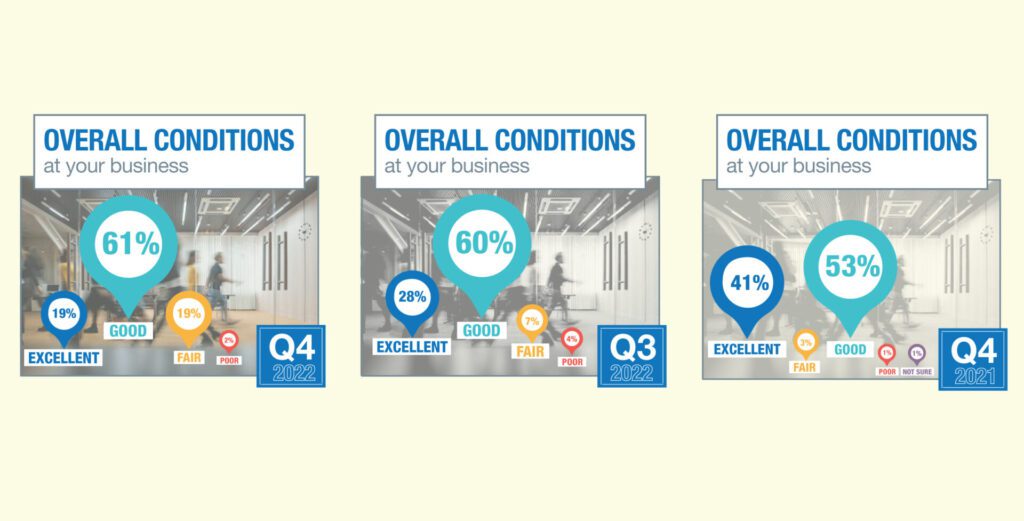

Some erosion in business conditions is evident, though. Nineteen percent said overall conditions at their business were excellent, compared with 41 percent a year ago. The number describing them as fair jumped from 3 percent a year ago to 19 percent in December.

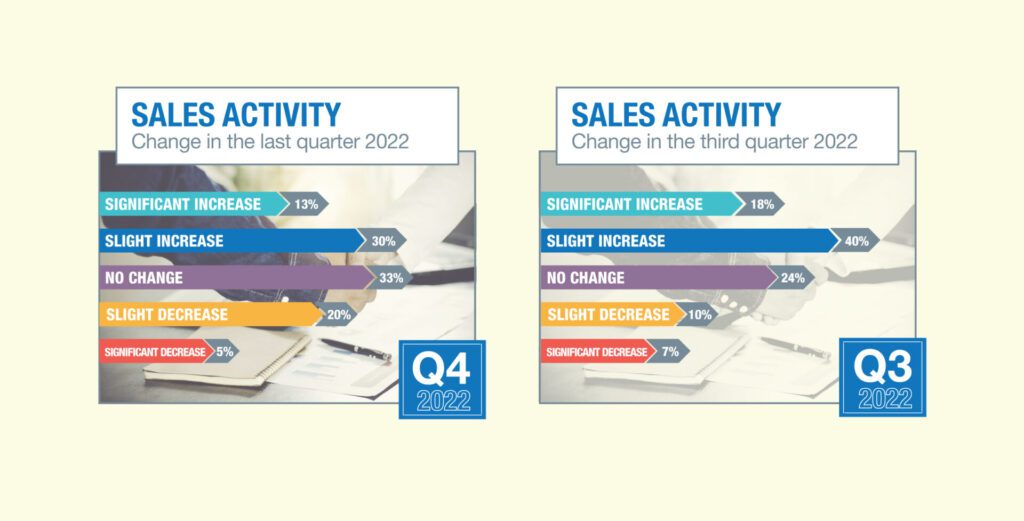

Many are still reporting solid sales activity, though 20 percent reported a slight decrease in the past quarter.

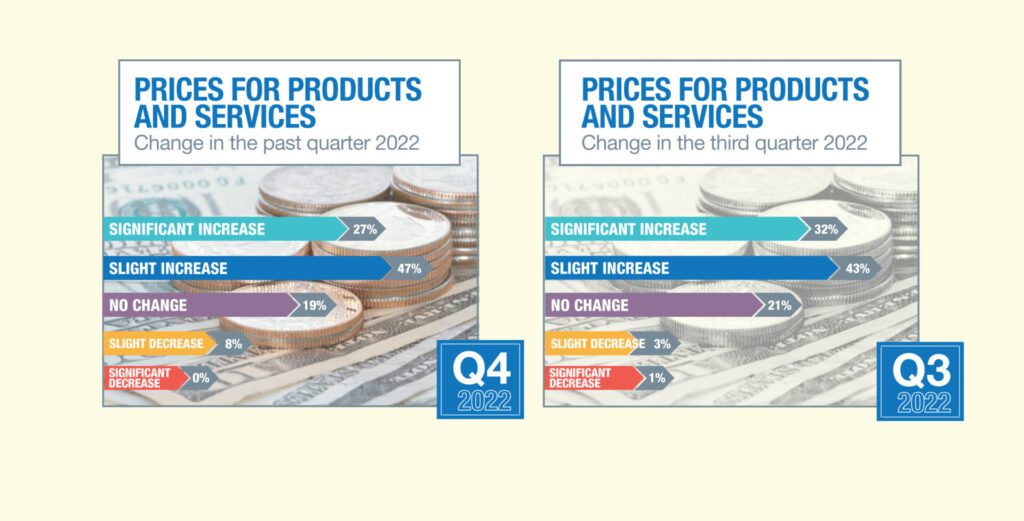

Prices were up but on par with increases reported in the previous quarter.

Hiring in the previous quarter was fairly steady, though 8 percent reported a drop in hiring.

Survey results also are provided to the Sioux Falls Development Foundation and the Federal Reserve Bank of Minneapolis to assist in their understanding of area business conditions.

“This is consistent with what I’m experiencing — still confident in Sioux Falls and S.D. but skeptical of national trends,” said Bob Mundt, president and CEO of the Sioux Falls Development Foundation.

“I believe our businesses are culturally conservative and thus cautious when it comes to capital spending, debt and general operational efficiencies. Inflation, interest rates, supply chain uncertainty, low unemployment and political unrest all play a role in how our companies are implementing their decisions — hunker down and wait for the opportunity. Short-term sacrifices for long-term gain.”

While there were noticeable declines in sentiment through 2022, “overall, CEOs in the Sioux Falls region seem to continue to be more positive than I see elsewhere in the national or Ninth District economies but by a smaller margin than in previous surveys when Sioux Falls seemed to be in something of a Goldilocks economy,” said Ron Wirtz, regional outreach director for the Minneapolis Fed.

“And by comparison, there are likely a lot of folks that might want to trade economic places.”

For instance, while 80 percent said overall business conditions are good or excellent, the share saying “excellent” has been cut in half since the first quarter of 2022.

“I consider that over-the-top sentiment to be more of the outlier,” Wirtz said. “Current levels are still very healthy, though there are a few signs of growing stress. Inflation is still clearly an issue, as almost two-thirds are seeing slight or significant price increases over the past quarter.”

While sales and hiring showed a steady decline, they’re still net positive, he added.

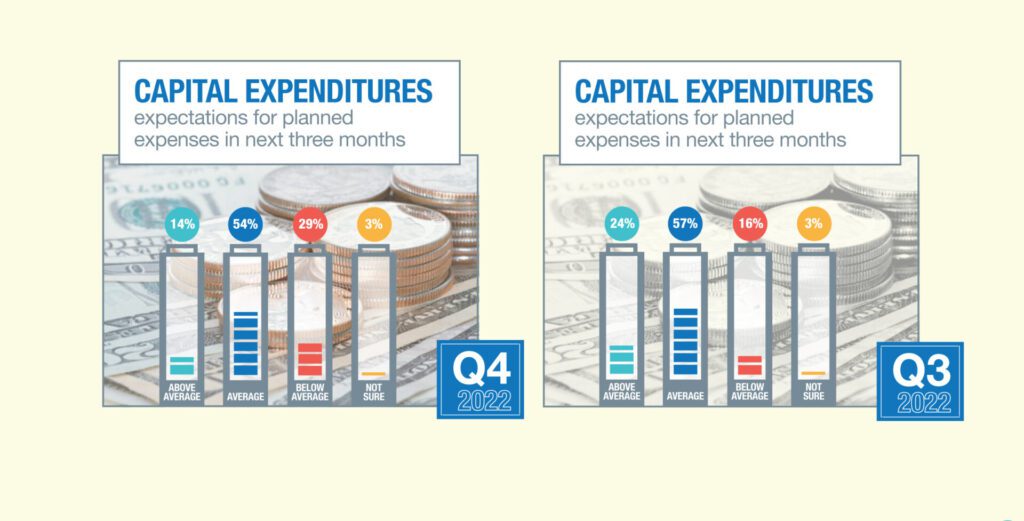

“Capital improvements have held up pretty well, which is also a good sign; investment in future sales is often the first things to go in times of volatility,” Wirtz said.

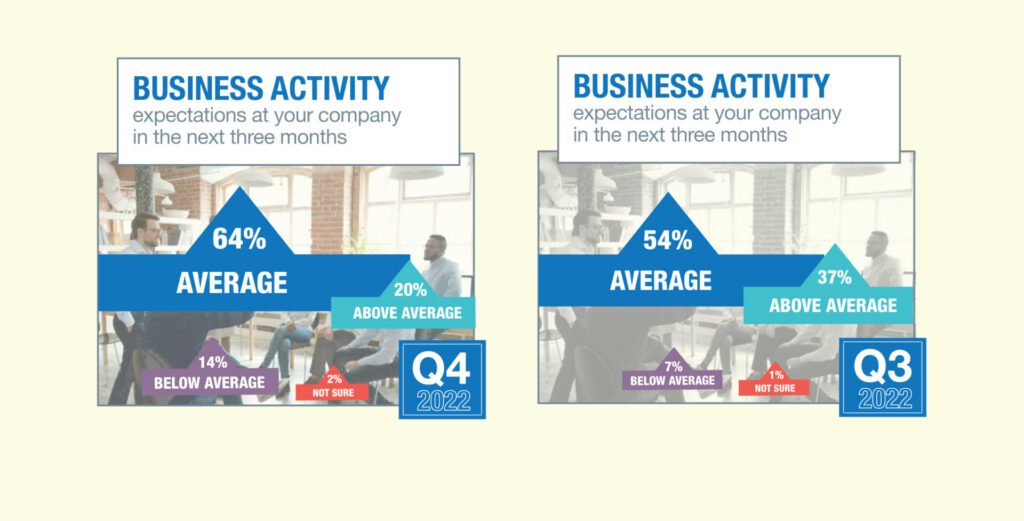

Looking ahead, the majority of CEOs predict at least average anticipated business activity.

“For future business activity, the share expecting above-average activity has fallen notably. That’s certainly not ‘positive,’ but at least some of that had to be expected; that’s a typical regression to the mean even under good circumstances,” Wirtz said. “Plus, the way the question is worded, I could also interpret ‘average’ to be quite good given past responses.”

CEOs also remain largely in hiring mode, with one in four predicting above-average hiring in the first quarter.

They are somewhat more conservative on capital spending, with 29 percent predicting it will be below average to start the year.

Like the CEOs surveyed, Nesiba said he remains bullish on Sioux Falls.

“Federal policymakers are trying to engineer a soft landing. They want to bring down inflation by hiking interest rates, cutting federal spending and avoiding a recession that will push up unemployment. That seems possible but doubtful at the national level,” he said. “However, here in Sioux Falls, our strong population growth, construction growth and high expectations of business activity, capital expenditures and hiring suggest that even in the face of a national recession, we are poised to perform better than the rest of the country.”

Sioux Falls Development Foundation resources

Do you have further information to share about conditions at your business? Or are you looking to connect to additional resources to support your growth? The Sioux Falls Development Foundation can assist you in the following areas:

- Workforce development: The Development Foundation offers programs and initiatives to help you attract, retain and develop your workforce. Contact Denise Guzzetta, vice president of talent and workforce development, at 605-274-0475 or [email protected].

- Business growth and expansion: Whether your business is planning an expansion in the next five years or facing risk factors impacting growth, the Development Foundation can help by discussing existing building space, available land, potential local and state incentives and other resources. Contact Mike Gray, director of business expansion and retention, at 605-274-0471 or [email protected].

[ad_2]

Source link