[ad_1]

Dendur Capital LP, a New York-based investment firm, has increased its holdings in shares of Global Business Travel Group, Inc. by 42.7% during the fourth quarter of the fiscal year ending March 2023. According to the latest SEC filing, the fund owned 1,734,773 shares of Global Business Travel Group’s stock after purchasing an additional 518,900 shares during the quarter. Global Business Travel Group accounts for approximately 2.1% of Dendur Capital LP’s portfolio and is now its 12th largest position.

Global Business Travel Group provides a leading business-to-business (B2B) travel platform both domestically and internationally. This travel platform offers a range of technology-enabled solutions to business travelers and clients while also catering to travel content suppliers such as airlines, hotels, ground transportation providers and aggregators as well as third-party travel agencies.

Credit Suisse Group recently reissued an “outperform” rating for Global Business Travel Group’s stock and issued a $9.00 price objective in their report on Friday, March 10th which markets have been following closely. In contrast, Morgan Stanley decreased their share price objective from $9.00 to $8.00 on Friday March 10th and assigned an “equal weight” rating for the company while Citigroup analysts recently boosted their price target for Global Business Travel Group from $6.50 to $7.50 in a report on Sundaymarch 12th.

At this time, two equity research analysts have rated Global Business Travel Group stock with a hold rating while four have assigned it with a buy rating.The average rating given by these analysts at the moment is Moderate Buy with an average share price goal forecast of $8.68 according to data from Bloomberg.

With these reports in mind, it is clear why Dendur Capital LP appears optimistic regarding its investments in Global Business Travel Group Inc., generating increased revenue from shares as well as adding to its already impressive portfolio. As we continue into 2023, only time will tell the future of Global Business Travel Group and whether the investment firm’s decision was a wise one indeed.

Institutional Investors and Hedge Funds Show Growing Interest in Global Business Travel Group

Investors and Hedge Funds Show Interest in Global Business Travel Group

Global Business Travel Group (GBTG) has been gaining the attention of institutional investors and hedge funds, as several of them have been adding to or reducing their stakes in the company. Vanguard Group shows a new stake in GBTG valued at $1,127,000 during the third quarter, while Geode Capital Management LLC increased its stake by 76.9% during the fourth quarter to own 176,058 shares worth $1,188,000. JPMorgan Chase & Co. also purchased a new stake during the second quarter at approximately $882,000, and BlackRock Inc. shows interest with its own purchase of a new stake valued at $704,000 during the third quarter.

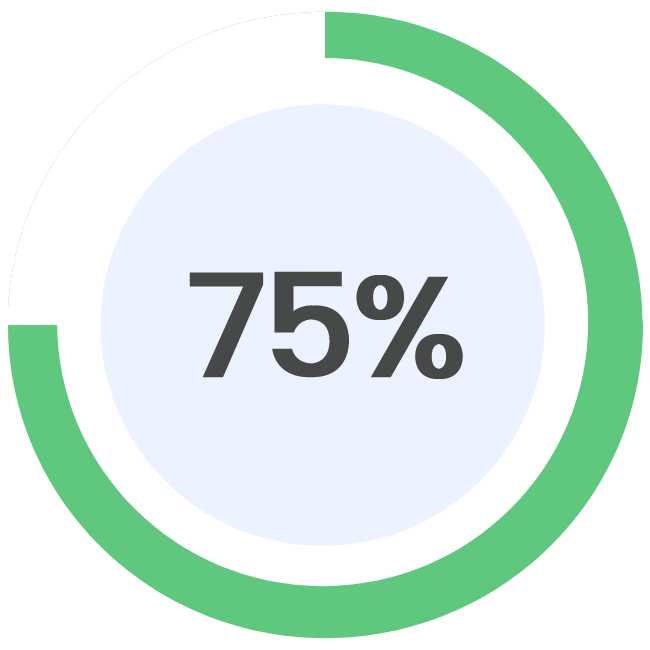

Prelude Capital Management LLC’s investment in GBTG increased by 13.4% during Q3 after purchasing an additional 5,733 shares worth $275,000. According to reports released on June 13th this year regarding GBTG stock ownership percentages amongst hedge funds and other institutional investors; presently such parties own 15.91% of GBTG stock.

The opening price for NYSE GBTG stocks on June 13th went to roughly $7.96 USD with market capitalization amounting to roughly $3.70 billion USD accompanied by a price-to-earnings ratio of -12.84 and beta index score of 0.27.

GBTG has experienced considerable changes regarding investor confidence during the last year as its twelve-month low was recorded at an all-time low of just $4.26 USD with highs peaking at an amazing high of almost double that number: closing at around $8.40 USD within recent weeks.

Additionally, CEO Paul G.Abbott is reported to have displayed great confidence in his company having purchased more than eight thousand shares worth approximately fifty-one thousand dollars ($50,918.75 USD) on May 16th, 2023. This move has brought his total stock ownership to upwards of two and a half million stocks at the cost of $6.25 per share bringing his total value of GBTGV shares near to $15,857,656.25 USD.

The acquisition itself was declared via SEC filing protocols and the details remain available through the SEC website currently. It is estimated that insiders presently own up to around 5% of GBTG stocks on the market.

In conclusion, while holding onto a current ratio of 1.64 and quick ratio of 1.64 augmented by a debt-to-equity ratio valued at one point zero (1:00), such recent purchases from various financial magnates working in both institutional investment sectors and hedge funds definitely proves that confidence in Global Business Travel Group’s stock investment potential is growing significantly as their stock begins to shine as an attractive option for those in search of investments with great returns potential.

[ad_2]

Source link