[ad_1]

Attention, home buyers, homeowners and renters: 2024 might treat you more kindly than 2023 did.

The housing market was downright hostile in 2023. The 30-year mortgage rate rose from about 6% in February to 8% in October. The median home price peaked above $400,000. Home affordability plunged.

2024 will bring lower mortgage rates, forecasters predict. If they’re right, home buyers will gain purchasing power. “It’ll be nice to move past the point where we’re not setting new records for unaffordability,” says Danielle Hale, chief economist for Realtor.com.

2024 will bring lower mortgage rates, forecasters predict.

If optimistic forecasts are accurate, more homeowners might list their homes for sale in 2024, even if it means giving up their low mortgage rates. And renters might get some relief too.

People are also reading…

Here are mortgage and housing trends to watch for in 2024.

Mortgage rates should trend a little lower

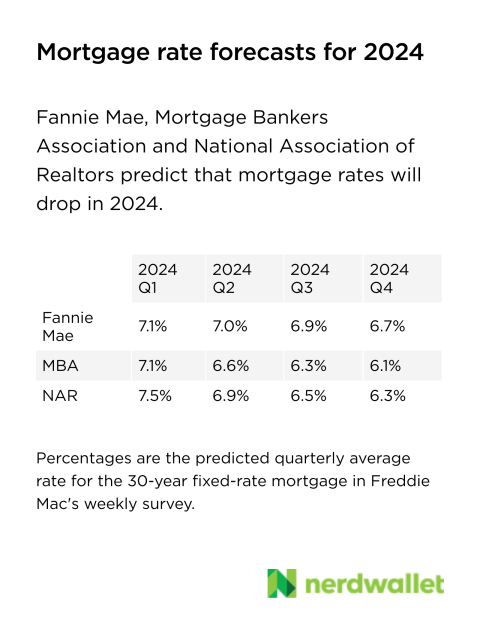

Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors all predict that the 30-year mortgage rate will fall to below 7% in the second half of 2024.

Daryl Fairweather, chief economist for Redfin, agrees that rates will fall, but she cautions that the decline won’t be smooth. “I think there will be swings,” she says. “And the swings will be large, both up and down. But the trend will be, on average, down.”

A couple of things to keep in mind. First, the three organizations failed to forecast the rise in mortgage rates in 2023. Second, even if they’re correct about rates falling in 2024, they still predict that the 30-year mortgage will end the year above 6%. They’re not saying that rates will fall to the sub-4% levels seen from 2019 and into 2022.

“I think the era of very low interest rates was just like a once-in-a-generation thing to happen,” says Dave Liniger, who co-founded Re/Max Holdings, a real estate franchiser, two generations ago in 1973. “And I just don’t see it going back.”

But home prices won’t fall much, if at all

If you hope for plunging prices, you’re probably not going to get your wish in 2024.

If prices fall — and that’s a big “if” — they won’t decline much, because the market has reached a persistent equilibrium: Few homes were on the market toward the end of 2023, and buyers were deterred by high interest rates. The standoff is likely to continue. Home prices won’t fall until buyers are outnumbered by sellers.

“We just have very, very few sellers,” said Mike Simonsen, president of real estate analytics firm Altos Research, in a video presentation on Oct. 23. “Declining home prices probably require that supply-and-demand imbalance, and what we have is really a balance. There’s a balance between low demand and low supply.”

If lower rates revive demand, won’t that drive prices higher? Economic theory says yes. But human behavior is more complex than economic theory.

“In general, you would expect that if mortgage rates fall, it creates more affordability and that should kind of boost housing demand, which might then push prices back up,” Hale says. “I don’t expect that we’re going to see that trend in 2024.”

Why not? Affordability, Hale says. Buyers’ finances are already stretched to the limit, so there won’t be much room for home prices to rise, even if mortgage rates fall.

More new construction of single-family homes

Until more houses hit the market, prices don’t have much room to move down.

Help is on the way. Builders are applying for more permits to construct single-family houses. They sought 968,000 permits in October at a seasonally adjusted annual rate, the most since May 2022. When those houses are completed, they’ll add to the total housing supply.

And it’s about time for more single-family houses to get built, says Erin Sykes, chief economist for Nest Seekers International, a multinational real estate brokerage. “We’ve had this ongoing conversation about the shortage of housing, which is true, generally speaking,” she says, “but it’s actually a shortage with more of an asterisk. We have an oversupply of multifamily and a shortage of single-family.”

Renters might get a break

Rents skyrocketed starting in 2021, prompting developers to build apartments. As those units are completed, rents are going down a tiny bit, according to Realtor.com‘s monthly rental report.

The median asking rent of $1,747 in September was $5 less than in August, and $29 less than the peak in July 2022, according to the report co-written by Jiayi Xu and Hale. Rents are going down because of an apartment construction spree. In the first 10 months of 2023, builders had completed 361,000 multifamily units, a 24% increase over the same period a year earlier.

And there’s more where that’s coming from: More than 980,000 multifamily units were under construction in October. The vast majority are apartments, and many of them will be ready for occupancy by the end of 2024. “That is going to help bring rents to a slightly more affordable place,” Hale says.

Rate lock-in may begin to ease

For every 20 homes that were for sale at the end of October 2019, just 13 were for sale in October 2023. This decline is blamed on a phenomenon called rate lock-in.

Rate lock-in occurred as people bought homes, or refinanced their mortgages, when mortgage rates were low — often below 4% — in 2020 and 2021. Those homeowners are reluctant to sell their homes and give up those low rates. They are locked in.

Economists believe two factors — time and falling rates — are the keys. “As mortgage rates come down, as homeowners build equity, I think we’ll start to see the lock-in effect abate,” Hale says. More people will list their homes for sale, giving buyers more houses to choose from and relieving some of the upward pressure on prices. This will be a multi-year process.

Lawsuits could change how agents are paid

Class-action lawsuits against the National Association of Realtors and some real estate brokerages could shake up the way real estate agents are paid, potentially leading to significant changes in the way homes are bought and sold.

On Oct. 31, a federal jury in Kansas City, Missouri, decided that the NAR had imposed anticompetitive rules that required home sellers to pay nonnegotiable, excessive commissions to buyer’s agents. The jury assessed damages of close to $1.8 billion against NAR and two co-defendant brokerages; the NAR has said it will appeal. (Two brokerages settled before trial for a combined total of $138.5 million in damages.)

Meanwhile, a similar antitrust case is expected to begin in a federal court in Illinois in 2024, and other class-action suits have been filed in other states. Home sellers, buyers and real estate agents might end up conducting transactions differently, depending on how these cases are decided in 2024 and beyond.

There’s much uncertainty about 2024, including the outcomes of those lawsuits. But all in all, the outlook is for an improvement over 2023.

The 50 places where homes are taking the longest to sell

#50. Madison, Wisconsin

– Median days on market: 39

– Total homes sold: 711

– Median sale price: $396,000

#49. Gary, Indiana

– Median days on market: 39

– Total homes sold: 768

– Median sale price: $253,250

#48. Ocala, Florida

– Median days on market: 39

– Total homes sold: 991

– Median sale price: $270,000

#47. Charlotte, North Carolina

– Median days on market: 39

– Total homes sold: 3,719

– Median sale price: $395,000

#46. Greeley, Colorado

– Median days on market: 40

– Total homes sold: 523

– Median sale price: $496,512

#45. Raleigh, North Carolina

– Median days on market: 40

– Total homes sold: 2,094

– Median sale price: $440,000

#44. Prescott Valley, Arizona

– Median days on market: 41

– Total homes sold: 363

– Median sale price: $525,000

#43. Spartanburg, South Carolina

– Median days on market: 41

– Total homes sold: 463

– Median sale price: $291,108

#42. Daphne, Alabama

– Median days on market: 41

– Total homes sold: 608

– Median sale price: $390,000

#41. New Brunswick, New Jersey

– Median days on market: 41

– Total homes sold: 2,292

– Median sale price: $479,000

#40. Riverside, California

– Median days on market: 41

– Total homes sold: 4,249

– Median sale price: $550,000

#39. San Antonio

– Median days on market: 42

– Total homes sold: 3,070

– Median sale price: $325,000

#38. Hickory, North Carolina

– Median days on market: 43

– Total homes sold: 366

– Median sale price: $276,500

#37. Poughkeepsie, New York

– Median days on market: 43

– Total homes sold: 485

– Median sale price: $390,000

#36. Knoxville, Tennessee

– Median days on market: 43

– Total homes sold: 1,161

– Median sale price: $369,950

#35. Birmingham, Alabama

– Median days on market: 43

– Total homes sold: 1,337

– Median sale price: $299,950

#34. Asheville, North Carolina

– Median days on market: 44

– Total homes sold: 648

– Median sale price: $440,000

#33. Elgin, Illinois

– Median days on market: 44

– Total homes sold: 812

– Median sale price: $328,995

#32. Las Vegas

– Median days on market: 44

– Total homes sold: 3,138

– Median sale price: $412,995

#31. Lake County, Illinois

– Median days on market: 45

– Total homes sold: 969

– Median sale price: $340,000

#30. Deltona, Florida

– Median days on market: 45

– Total homes sold: 1,536

– Median sale price: $350,000

#29. Jacksonville, Florida

– Median days on market: 45

– Total homes sold: 2,770

– Median sale price: $365,000

#28. Nashville, Tennessee

– Median days on market: 45

– Total homes sold: 3,246

– Median sale price: $449,000

#27. Green Bay, Wisconsin

– Median days on market: 46

– Total homes sold: 303

– Median sale price: $286,500

#26. Kingsport, Tennessee

– Median days on market: 46

– Total homes sold: 323

– Median sale price: $250,000

#25. Greenville, South Carolina

– Median days on market: 47

– Total homes sold: 1,303

– Median sale price: $325,000

#24. Montgomery, Alabama

– Median days on market: 48

– Total homes sold: 452

– Median sale price: $245,368

#23. Clarksville, Tennessee

– Median days on market: 48

– Total homes sold: 577

– Median sale price: $309,450

#22. Pittsburgh

– Median days on market: 48

– Total homes sold: 2,079

– Median sale price: $225,000

#21. Chicago

– Median days on market: 48

– Total homes sold: 7,747

– Median sale price: $330,000

#20. Tallahassee, Florida

– Median days on market: 49

– Total homes sold: 473

– Median sale price: $299,900

#19. Huntsville, Alabama

– Median days on market: 49

– Total homes sold: 836

– Median sale price: $330,000

#18. Tucson, Arizona

– Median days on market: 49

– Total homes sold: 1,408

– Median sale price: $370,000

#17. Austin, Texas

– Median days on market: 49

– Total homes sold: 3,217

– Median sale price: $468,250

#16. Phoenix

– Median days on market: 49

– Total homes sold: 7,388

– Median sale price: $449,900

#15. Sioux Falls, South Dakota

– Median days on market: 50

– Total homes sold: 359

– Median sale price: $326,000

#14. Panama City, Florida

– Median days on market: 50

– Total homes sold: 518

– Median sale price: $375,000

#13. Pensacola, Florida

– Median days on market: 51

– Total homes sold: 968

– Median sale price: $336,859

#12. Fort Lauderdale, Florida

– Median days on market: 52

– Total homes sold: 2,878

– Median sale price: $420,000

#11. Charleston, South Carolina

– Median days on market: 54

– Total homes sold: 1,528

– Median sale price: $439,950

#10. New Orleans

– Median days on market: 55

– Total homes sold: 1,200

– Median sale price: $292,750

#9. Port St. Lucie, Florida

– Median days on market: 59

– Total homes sold: 1,023

– Median sale price: $395,000

#8. Palm Bay, Florida

– Median days on market: 59

– Total homes sold: 1,217

– Median sale price: $353,230

#7. Miami

– Median days on market: 60

– Total homes sold: 2,477

– Median sale price: $520,000

#6. McAllen, Texas

– Median days on market: 61

– Total homes sold: 375

– Median sale price: $250,000

#5. West Palm Beach, Florida

– Median days on market: 61

– Total homes sold: 2,804

– Median sale price: $470,000

#4. Honolulu

– Median days on market: 62

– Total homes sold: 703

– Median sale price: $708,500

#3. New York

– Median days on market: 63

– Total homes sold: 4,910

– Median sale price: $700,000

#2. Sebastian, Florida

– Median days on market: 71

– Total homes sold: 424

– Median sale price: $380,000

#1. Myrtle Beach, South Carolina

– Median days on market: 75

– Total homes sold: 1,932

– Median sale price: $342,538

Data reporting by Elena Cox. Story editing by Jeff Inglis. Copy editing by Paris Close.

The article 2024 Housing Trends: Lower Rates, Lower Rents, More Affordability originally appeared on NerdWallet.

[ad_2]

Source link