[ad_1]

March 14, 2023

Click for PDF

Although the number of securities lawsuits filed this year remained steady compared to 2021, we have seen many notable developments in securities law. This year-end update provides an overview of the major developments in federal and state securities litigation since our last update in September 2022:

- The Supreme Court is set to hear a blockbuster case that will shape whether and how shareholders can establish standing to bring claims under Sections 11 and 12 of the Securities Act when a company sells its shares in a direct listing. The Supreme Court has also heard, or will hear, administrative law cases that will impact securities litigation. Several cases pending at the circuit court level may have wide-ranging effects on securities litigation as well.

- We review a number of significant developments in Delaware corporate law, including the Court of Chancery’s clarification of directors’ oversight duties, and the Delaware General Assembly’s expansion of Section 102(b)(7) of the Delaware General Corporation Law to include exculpation of officers for personal liability arising from breaches of the duty of care. We also provide an update on the status of mandatory federal forum provisions in the Ninth and Seventh Circuits and in the State of California.

- We examine developments in federal securities litigation involving special purpose acquisition companies. Although the market for SPAC IPOs has cooled relative to 2021, litigation arising out of SPAC transactions remains active, and courts have started to rule on motions to dismiss in SPAC-related shareholder lawsuits, with several recent decisions finding plaintiffs’ allegations to be sufficient to move forward.

- We examine environmental, social, and corporate governance (“ESG”) developments. Although too early to identify definitive trends in this area, we survey the types of ESG allegations that are being filed and report on notable decisions.

- We continue to monitor the emergence of a potential circuit split regarding whether the Supreme Court’s 2019 decision in Lorenzo allows scheme liability under Rule 10b-5(a) and (c) without alleging dissemination and based solely on the same conduct as Rule 10b-5(b) misrepresentation claims. As discussed in our 2022 Mid-Year Securities Litigation Update, a number of courts have grappled with the effects of Lorenzo. In particular, the Second Circuit in SEC v. Rio Tinto provided much needed clarity for district courts within the Second Circuit. Since then, district courts in the Southern District of New York have evaluated scheme liability under Rio Tinto, but there have been no further opinions discussing the scope of Lorenzo in the other circuits.

- We again survey securities-related litigation arising out of the coronavirus pandemic, including securities class actions alleging that defendants made false claims about the efficacy of their COVID-19 vaccines, treatments, and tests. Although many cases involving false claims about pandemic and post-pandemic prospects are either moving into the motion to dismiss stage or have recently been dismissed, a handful of new cases have also been filed.

- We review developments regarding Omnicare’s falsity of opinions standard, as rulings by various circuit and district courts shed light on the boundaries of liability for false or misleading statements of opinion as well as omissions.

- Finally, we address several other notable developments in the federal courts, including:

- the Ninth Circuit upholding the dismissal of a securities class action after reaffirming its standard for non-actionable “puffery”;

- the First Circuit’s further guidance as to when statements regarding a product may be materially misleading under the PSLRA; and

- the Ninth Circuit becoming the second circuit court in less than a year to hold that social media posts can count as “soliciting” the purchase of a security under the Securities Act.

I. Filing And Settlement Trends

Data from a recently released NERA Economic Consulting (“NERA”) study shows federal securities litigation filing trends that began in earnest in 2020 continued through 2022. For the third consecutive year, federal class-action filings decreased after a steady upward trend in 2017-2019. As in 2021 and 2020, the decline in the number of merger-objection cases filed (down to eight from the peak of 205 in 2017) drove the decrease in the total number of new federal class actions filed in 2022 (down to 205 from the peak of 431 in 2018). For the second year in a row, the “Electronic Technology and Technology Services” and “Health Technology and Services” sectors represented over half of all filings (54%). In notable contrast to prior years, however, the number of crypto unregistered securities cases increased considerably, from just one in 2021 to 16 in 2022.

After declining to $8 million in 2021, the median settlement value of federal securities class actions in 2022—excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—increased to $13 million, which is consistent with the trend seen from 2018-2020 ($13, $12, and $13 million, respectively). Concomitantly, average settlement values—also excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—also increased in 2022 (to $38 million, up from $21 million in 2021).

A. Filing Trends

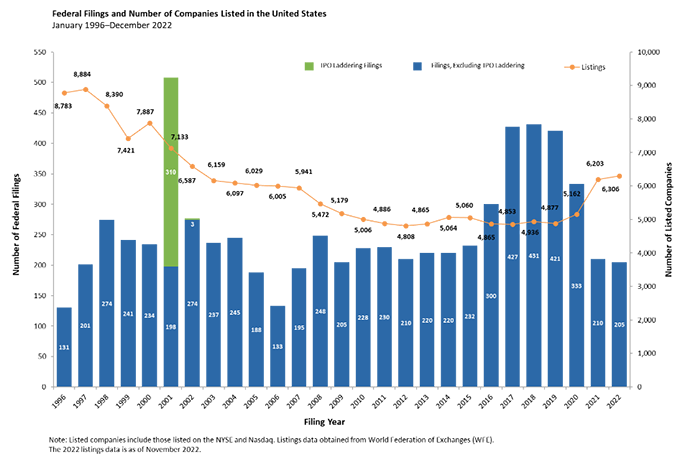

Figure 1 below reflects the federal filing rates in 2022 (all charts courtesy of NERA). 205 federal cases were filed last year, which is less than half the number of federal filings in the each of the peak years (2017-2019). Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

B. Mix Of Cases Filed In 2022

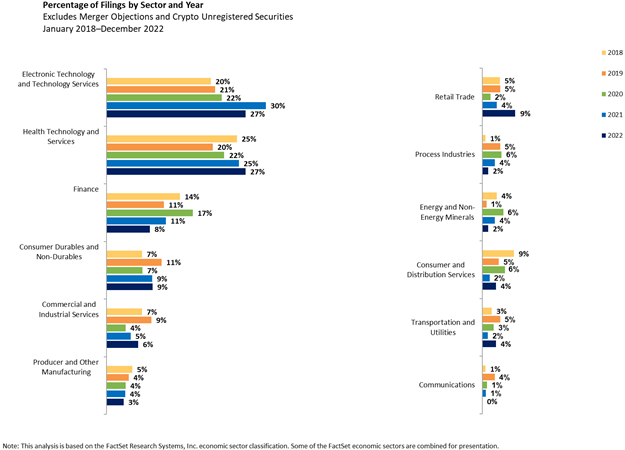

1. Filings By Industry Sector

As shown in Figure 2 below, the distribution of non-merger objection and non-crypto unregistered securities filings in 2022 was largely consistent with 2021. For the second year in a row, the “Electronic Technology and Technology Services” and “Health Technology and Services” sectors accounted for more than 50% of all filings. And after declining in 2021, “Finance” filings declined again (down to 8%), reaching a low watermark in recent years. Conversely, “Retail Trade” filings increased from 4% to 9%, the high watermark in recent years.

Figure 2:

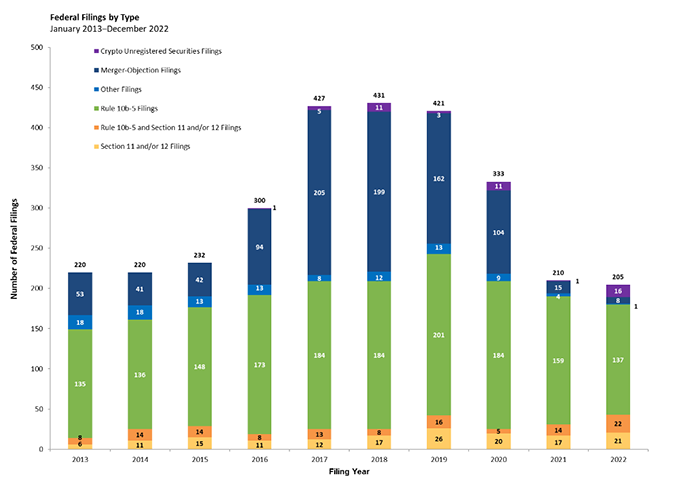

2. Merger Cases

As shown in Figure 3 below, eight merger-objection cases were filed in federal court in 2022. This represents a 47% year-over-year decrease from 2021, and a 92% year-over-year decrease from 2020. This figure is significantly lower than in 2016, when the Delaware Court of Chancery effectively put an end to the practice of disclosure-only settlements in In re Trulia Inc. Stockholder Litigation, 29 A.3d 884 (Del. Ch. 2016), which helped drive the increase in merger-objection filings between 2015 and 2017.

Figure 3:

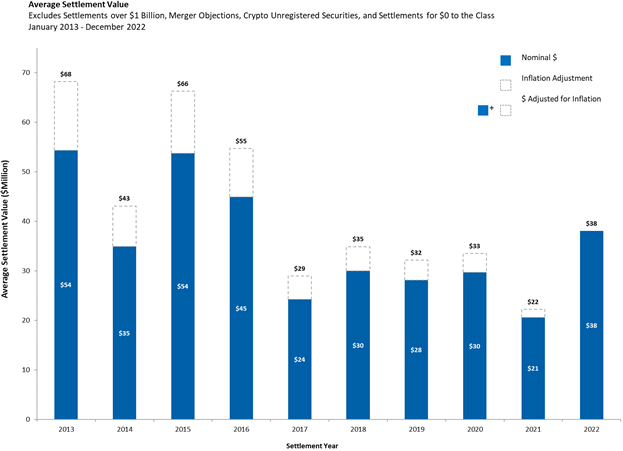

C. Settlement Trends

As reflected in Figure 4 below, the average settlement value—excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—nearly doubled from 2021 to 2022, reaching $38 million. $38 million is also the highest average settlement value since 2016.

Figure 4:

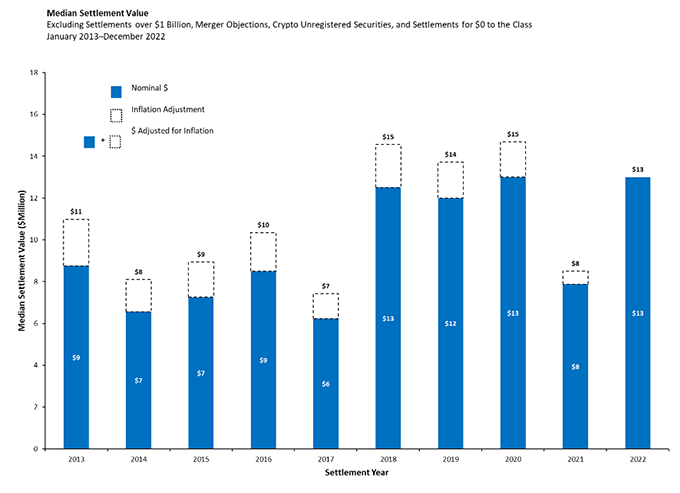

Turning to median settlement value, Figure 5 shows an increase from $8 million in 2021 to $13 million in 2022. This marks a return to the consistency of 2018 to 2020, when median settlement value remained $12-13 million. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 5:

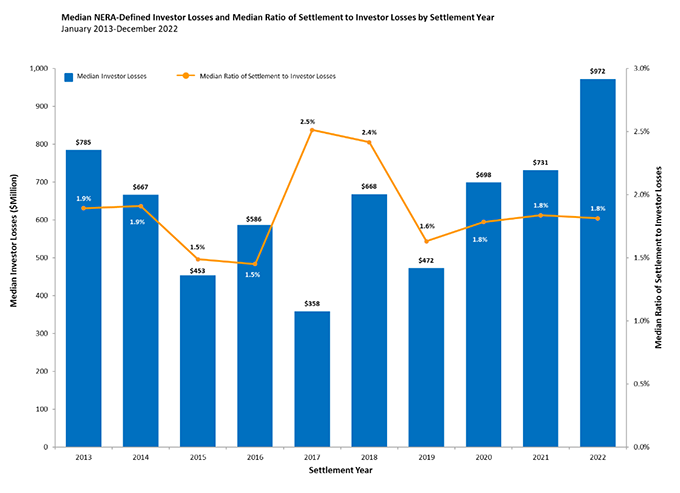

Finally, as shown in Figure 6, Median NERA-Defined Investor Losses increased in 2022, rising to $972 million from $731 million in 2021. Although Median NERA-Defined Investor Losses reached their highest level in a decade, the Median Ratio of Settlement to Investor Losses held steady for the third straight year at 1.8%.

Figure 6:

II. What To Watch For In The Supreme Court

The Supreme Court is set to hear a blockbuster case that is expected to shape whether and how shareholders can establish standing to bring claims under Sections 11 and 12 of the Securities Act when a company sells its shares in a direct listing. The Supreme Court has also heard, or will hear, administrative law cases that will impact different aspects of securities litigation. Several cases pending at the circuit court level may have wide-ranging effects on securities litigation as well.

A. The Supreme Court Takes On Slack v. Pirani

The case arises out of the New York Stock Exchange’s (“NYSE”) rule, introduced in 2018, that allows companies to go public through a direct listing. Id. at 944. In a traditional initial public offering (“IPO”), all of the shares initially sold to the public during the contractual lock-up are newly issued shares that are registered under a single registration statement. Id. at 943. In a direct listing, however, the company does not typically issue new shares. Id. at 944. Instead, only those shares that do not qualify for an exemption are registered for resale under the registration statement; existing shareholders may publicly sell unregistered shares pursuant to an exemption from registration. Id. So, while an investor who purchases shares during the contractual lock-up period following an IPO generally knows that the purchased shares were registered under the registration statement, an investor who purchases shares following a direct listing may not know if the purchased shares were registered or unregistered. Id.

In June 2019, Slack was one of the first companies to go public through a direct listing. Id. Over half of the shares that were available for resale to the public were unregistered shares held by existing shareholders. Id. Plaintiff bought shares on the day of the direct listing as well as on later dates. Id. He subsequently brought claims under Sections 11 and 12 of the Securities Act, alleging that the registration statement and prospectus Slack issued in connection with the direct listing omitted material information that rendered Slack’s required disclosures misleading. Id. at 944–45.

Sections 11 and 12 of the Securities Act provide a private right of action for alleged misstatements in a registration statement or prospectus by plaintiffs who purchased “such security.” 15 U.S.C. §77k(a) (Section 11); 15 U.S.C. §77l(a)(2) (Section 12). Under well-settled precedent, including from the Ninth Circuit, plaintiffs must be able to plead and prove that the shares they purchased were registered under the registration statement being challenged. Courts have long recognized that in cases with multiple registration statements (such as when a company issues a secondary offering), it is often impossible for plaintiffs to plead and prove their shares were registered under a specific registration statement because of the difficulty of determining the origin of the shares they purchased. Pirani, 13 F.4th at 946. Based on this well-established precedent, Slack argued plaintiff lacked standing because he admitted that he could not plead and prove that the shares he bought after Slack’s direct listing were registered. Id. at 948.

In a split decision, the Ninth Circuit held that “Slack’s unregistered shares sold in a direct listing are ‘such securities’ within the meaning of Section 11 because [by virtue of NYSE rules] their public sale cannot occur without the only operative registration in existence,” and thus “[a]ny person who acquired Slack shares through its direct listing could do so only because of the effectiveness of its registration statement.” Id. at 947. The court further noted that “[b]ecause this case involves only one registration statement,” it “does not present the traceability problem identified by [the Ninth Circuit] in cases with successive registrations.” Id. Judge Miller dissented, arguing that the majority improperly based its holding on the text of NYSE rules instead of the text of the statutes at issue; that there was no principled distinction between successive-registration cases and this one; and that the majority’s reliance on policy arguments was improper. Id. at 952–53 (Miller, J., dissenting).

In its petition for certiorari before the Supreme Court, Slack argued that all seven circuits to have considered the issue have uniformly held that “such security” means a share registered under the registration statement that is challenged by the plaintiff as misleading. Petition for Writ of Certiorari at 3–4. Slack also explained how this interpretation of the statutory language reflects the balancing of policy objectives that Congress implemented in the statutory scheme—namely, that while “Sections 11 and 12 impose ‘virtually absolute’ liability, ‘even for innocent misstatements,’” these statutes “are ‘limited in scope’ because they severely curtail the class of shareholders who may sue.” Id. at 28 (quoting Herman & MacLean v. Huddleston, 459 U.S. 375, 381–82 (1983)). And “Section 10 of the Exchange Act, by contrast, ‘is a “catchall” antifraud provision’ that permits any shareholder to sue, but ‘requires a plaintiff to carry a heavier burden to establish a cause of action.’” Id. Slack also warned that following the Ninth Circuit’s policy-based reasoning would mark a significant departure from precedent and undermine the stability of the securities markets and the efficiency of the capital-formation process.

The Supreme Court granted the petition for a writ of certiorari. Gibson Dunn represents Slack in this litigation. The case will be argued on April 17, 2023, by Thomas Hungar, a Gibson Dunn partner in the Washington, D.C. office.

B. Potential Circuit Split After Lee v. Fisher

On December 12, 2022, the Ninth Circuit heard oral argument en banc in Lee v. Fisher, No. 21-15923, a case that could create a circuit split between the Ninth and Seventh Circuits. The issue is whether investors can file derivative suits in federal court when a company has a forum-selection clause in its bylaws that mandates such cases be filed in Delaware state court. Prior to granting en banc review, the original Ninth Circuit panel affirmed the district court’s ruling that the forum-selection clause was enforceable, precluding a claim under Section 14(a) of the Exchange Act. See Lee v. Fisher, 34 F.4th 777, 782 (9th Cir. 2022). That decision created a circuit split, as the Seventh Circuit had recently held that a similar forum-selection clause was not enforceable. Seafarers Pension Plan v. Bradway, 23 F.4th 714, 724 (7th Cir. 2022).

In Lee, plaintiff brought a derivative action against The Gap, Inc. 34 F.4th at 779. Although Gap’s bylaws contained a forum-selection clause that required any derivative action to be brought in the Delaware Court of Chancery, plaintiff brought a derivative suit in a federal district court in California, alleging a Section 14(a) violation. Id.

The three-judge panel held that the forum-selection clause was enforceable. First, it did so because Supreme Court precedent favors enforcement of such clauses absent “extraordinary circumstances.” Id. at 780 (quoting Atl. Marine Constr. Co. v. U.S. Dist. Ct. for W. Dist. of Tex., 571 U.S. 49, 52 (2013)). Second, in considering whether the forum-selection clause would contravene strong public policy, the court held that neither the Exchange Act’s anti-waiver provision, 15 U.S.C. § 78cc(a), nor its exclusive federal jurisdiction provision, 15 U.S.C. § 78aa, was reason enough to overcome the strong federal policy in favor of enforcing forum-selection clauses. Id. at 781.

Gibson Dunn will continue to monitor developments on this issue.

C. Update On Arkansas Teachers Retirement System v. Goldman Sachs

Continuing our coverage of Goldman Sachs Group Inc. v. Arkansas Teacher Retirement System, 141 S. Ct. 1951 (2021), which dealt with the standard for considering evidence of price impact, we have a brief update on the case.

In our 2021 Year-End Securities Litigation Update, we covered In re Goldman Sachs, No. 16-250, when the case was heard on remand to the Second Circuit. There, the Second Circuit in turn remanded the case to the Southern District of New York with instructions on how to assess price impact, and the district court certified the class for the third time. Defendants appealed the class certification decision, setting up another showdown in the Second Circuit. Over several months in 2022, the parties and over 50 amici filed briefs. Oral argument was held on September 21, 2022 before Judges Sullivan, Chen, and Wesley. The Second Circuit has yet to issue a decision, but one is expected soon.

We will continue to follow the case and other developments in this area. We anticipate that the Second Circuit’s upcoming opinion will address the extent to which a mismatch between the challenged statement and corrective disclosure can undermine the evidence of price impact in cases based on the inflation-maintenance theory, and we will report on significant matters in future updates.

D. The Supreme Court Is Again Being Asked To Decide On The Constitutionality Of The CFPB

On October 19, 2022, the Fifth Circuit decided Community Financial Services Association of America v. Consumer Financial Protection Bureau, 51 F.4th 616 (5th Cir. 2022) (“CFSA”), which does not deal with securities litigation directly, but is an interesting challenge in the administrative law space and could be consequential to agencies who have faced or currently face structural challenges, like the Securities and Exchange Commission.

In CFSA, trade associations representing payday lenders sought to block the CFPB from implementing a “Payday Lending Rule.” Id. at 623. The rule would limit lenders’ ability to withdraw payments from a borrower’s account without first obtaining permission in cases where two attempts to withdraw payments from the account had already failed due to lack of sufficient funds. Id. at 625. The trade associations challenged the rule on two grounds: first, that the CFPB acted arbitrarily and capriciously and so exceeded its statutory authority; and second, that the rule is invalid because the CFPB’s funding structure is unconstitutional. Id. at 623.

The CFPB’s funding structure is considered unique among the federal agencies. In response to the 2008 financial crisis, Congress sought to ensure that the CFPB would be independent and insulated from partisanship. Instead of periodic congressional appropriations, the Bureau “receives funding directly from the Federal Reserve, which is itself funded outside the appropriations process.” Id. at 624. The Fifth Circuit held that the CFPB’s funding structure is unconstitutional because it violates the separation of powers and the Appropriations Clause. Id. at 635. The court held that Congress does not just cede direct control over the CFPB’s budget by insulating it from annual appropriations, it also ceded indirect control by providing it with self-determined funding from a source that is itself outside the appropriations process. This “double insulation from Congress’s purse strings [] is ‘unprecedented’ across the government.” Id. at 639. The court also held that the agency’s funding structure also violated the Appropriations Clause, which requires money to be drawn “from the Treasury … in Consequences of Appropriations made by law.” Id. at 640. Because the agency is not funded through an appropriation of Congress, it violates the Appropriations Clause.

On the issue of remedy, the Fifth Circuit used the dichotomy established in Collins v. Yellen, 141 S. Ct. 1761 (2021), as the framework. There, the Supreme Court clarified the difference between agency actions that involve a Government actor’s exercise of lawfully possessed powers and those that do not. CFSA, 51 F.4th at 642. For actions that fall into the latter group, a plaintiff must prove that the challenged action actually inflicted harm. The Fifth Circuit found that the unconstitutional funding scheme fell into the latter half of Collins; it also found that Plaintiff-Appellants succeeded in showing a linear nexus between the challenged funding scheme and the rule. Id. at 643. It reasoned, “without [the agency’s] unconstitutional funding, the Bureau lacked any other means to promulgate the rule.” Id. Accordingly, the court held that the Bureau’s Payday Lending Rule was to be vacated as the product of an unconstitutional funding scheme. Id.

The CFPB appealed the Fifth Circuit’s decision to the Supreme Court. We will report on further developments in future Updates.

E. Update On Securities And Exchange Commission v. Cochran

As previewed in our 2022 Mid-Year Securities Litigation Update, on November 7, 2022, the Supreme Court heard oral argument in Securities and Exchange Commission v. Cochran, No. 22-448. The case involves the question of whether requiring plaintiffs to bring constitutional challenges to an agency’s structure through that agency’s administrative proceedings prior to any such challenge in federal court violates due process. After nearly three hours of argument in Cochran and its companion case, the Supreme Court seemed receptive to opening up federal courts to Constitutional challenges of agencies outside of their internal process.

This case could have significant implications for defendants in enforcement proceedings before these types of agencies in part because it could permit defendants to pause enforcement proceedings to adjudicate their constitutional challenge separately in court.

In Cochran, attorneys from Gibson Dunn submitted amicus briefs supporting Cochran in the Supreme Court on behalf of Raymond J. Lucia, Sr., George R. Jarkesy, Jr., and Christopher M. Gibson, and in the Fifth Circuit on behalf of the Texas Public Policy Foundation. Attorneys from Gibson Dunn represented petitioners Lucia and Raymond J. Lucia Companies, Inc. in their successful challenge to the constitutionality of the SEC’s administrative law judge appointments.

III. Delaware Developments

A. Case Law Surrounding Corporate Oversight Duties Continues To Develop

In recent years, there have been several developments regarding duty of oversight claims—often called Caremark claims. As we reported in our 2017 Year-End Securities Litigation Update and 2019 Mid-Year Securities Litigation Update, a Caremark claim generally seeks to hold directors personally accountable for damages to a company arising from their failure to properly monitor or oversee the company’s major business activities and compliance programs. See In re Caremark Int’l Inc. Derivative Litig., 698 A.2d 959, 968 (Del. Ch. 1996). There are generally two types of Caremark claims: (1) that the directors utterly failed to implement any reporting or information systems or controls; and (2) having implemented such a system or controls, the directors consciously failed to monitor or oversee its operations, thus preventing themselves from being informed of risks or issues (a “red-flags” claim).

In a recent case, the Delaware Court of Chancery once again reaffirmed that plaintiffs must clear a high bar to adequately plead Caremark claims. On June 30, 2022, the Delaware Court of Chancery dismissed Caremark claims because it found that the board had implemented a reporting system for a “mission critical” risk and made good faith efforts to monitor risk. City of Detroit Police & Fire Ret. Sys. ex rel. NiSource, Inc. v. Hamrock, 2022 WL 2387653 (Del. Ch. June 30, 2022). Plaintiffs had asserted claims under both prongs of Caremark after a company experienced pipeline explosions. Id. at *1. The court dispensed with the prong-one Caremark claim, determining that the board had made good-faith efforts to establish a committee to oversee and report on safety policies. Id. at *15–17. The court noted that the committee met “five times a year, receiv[ed] extensive reports from senior executives, and regularly report[ed] on safety risks to the full [b]oard.” Id. at *15.

The court also rejected plaintiffs’ theories advanced under Caremark’s second prong. To that end, the court rejected plaintiffs’ argument that the board’s “regrettable” timeline to achieve regulatory compliance was a violation of positive law, reasoning instead that determining how to comply with regulations is “a legitimate business decision for the [b]oard to make.” Id. at *18–19. The court also rejected plaintiffs’ theory that the board ignored red flags related to violations of pipeline safety laws because the alleged red flags were either “too attenuated” from the explosions or the board did not know about the red flags. Id. at *26. For example, the court noted that it was not reasonable to infer that record-keeping violations at one company subsidiary put the board on notice of record-keeping violations at another subsidiary, which allegedly contributed to the pipeline explosion. Id. at *25.

The duty of oversight continues to be an active area of development in Delaware courts. In particular, as we discuss in a client alert dated February 3, 2023, the Delaware Court of Chancery held for the first time that corporate officers owe a duty of oversight.

We will report on further developments in this space in our next Update.

B. Delaware General Assembly Permits Officer Exculpation For Duty Of Care Claims

Since the Delaware General Assembly adopted Section 102(b)(7) of the Delaware General Corporation Law in 1986, corporations have been permitted to eliminate personal liability of directors for monetary damages arising out of breaches of the fiduciary duty of care. Following a recent amendment to Section 102(b)(7), corporations may now limit personal liability of a range of corporate officers specifically identified in the statute. Like director exculpation, Section 102(b)(7) allows corporations to eliminate officer liability arising from direct stockholder claims for duty of care breaches, and it does not allow corporations to eliminate officer liability arising from duty of loyalty claims. Unlike director exculpation, officers may still be personally liable for derivative claims brought on behalf of the corporation.

Although the statutory amendment was effective August 1, 2022, officer exculpation under Section 102(b)(7) is not self-executing. Thus, to eliminate officer liability, a corporation must amend its certificate of incorporation, which requires approval from both the board of directors and the corporation’s stockholders. Once adopted, an exculpation provision only eliminates personal liability for conduct occurring after it is approved by stockholders and the amended certificate of incorporation is filed and accepted by the Delaware Secretary of State.

C. Non-Delaware Courts Contend With The Application Of Forum Selection Bylaws To Federal Securities Claims

State and federal courts around the country continue to grapple with the enforceability of mandatory forum selection bylaws adopted by Delaware corporations. Readers will recall that, in Salzberg v. Sciabacucchi, 227 A.3d 102, 133-34 (Del. 2020), the Delaware Supreme Court held that mandatory federal forum provisions were prima facie valid under Delaware law, but indicated that fact-specific enforceability of such provisions would likely be decided by courts in other jurisdictions. A growing number of courts across the country have done just that.

As discussed above, the Ninth Circuit at least temporarily eliminated a potential circuit split by granting en banc review in Lee, 34 F.4th 777. In April 2022, the California Court of Appeal, First Appellate District, issued its decision in Wong v. Restoration Robotics, Inc., 78 Cal. App. 5th 48, 80 (2022), affirming the trial court’s dismissal of Securities Act claims for inconvenient forum and finding that defendant’s federal forum provision was valid and enforceable. Following the Delaware Supreme Court’s decision in Salzberg, the California trial court dismissed the case on forum non conveniens grounds pursuant to the federal forum provision, concluding that plaintiff failed to show the provision was unenforceable, unconscionable, unjust, or unreasonable. Wong, 78 Cal. App. 5th at 60. The Court of Appeal affirmed, finding that Salzberg had settled the question of validity and that enforcement of the provision would not be “outside reasonable expectations” of the company’s stockholders. Id at 76-80. The decision in Wong is the first California Court of Appeal decision enforcing the federal forum provision of a Delaware corporation.

D. Court Of Chancery Confirms De-SPAC Mergers Are Subject To Entire Fairness

In January 2022, the Delaware Court of Chancery issued a decision that called into question (at least at the pleadings phase of the case) the fairness of a de-SPAC transaction. See In re MultiPlan Corp. S’holders Litig., 268 A.3d 784, 812 (Del. Ch. 2022). One year later, on January 4, 2023, the court did so again, this time emphasizing its view that “[t]he duties owed by the fiduciaries of a SPAC organized as a Delaware corporation are no different” from other corporations. Delman v. GigAcquisitions3, LLC, — A.3d —, 2023 WL 29325, at *16 (Del. Ch. Jan. 4, 2023). Although these decisions arise in the context of a particular (and relatively new) form of transaction, they draw on traditional principles of fiduciary duty to reach the result.

The dispute in Delman unfolded against the backdrop of the court’s opinion in Multiplan, where the court relied on “well-worn fiduciary principles” to hold that the entire fairness standard applies to a de-SPAC transaction. In re MultiPlan., 268 A.3d at 792. The court reasoned that the sponsor was conflicted because it would lose its investment in the SPAC if it did not consummate a merger before its deadline, meaning its preference for a value-decreasing merger over no merger was not shared with public stockholders. Id. at 813.

In Delman, the court applied the same principles and reached the same conclusion. 2023 WL 29325, at *16. Pursuant to the transaction at issue in Delman, as in many SPAC transactions, stockholders received a three-quarters warrant and one post-IPO share, with the option to redeem the share for $10.10 regardless of whether they voted for or against a proposed merger. Id. at *3, *6. After the de-SPAC closed and the price of the surviving company’s stock dropped to $6.57 per share, plaintiff alleged, among other things, that the SPAC had interfered with stockholders’ redemption rights by misstating the proposed merger consideration that stockholders would receive. Id. at *16 n.170, *21.

Echoing its decision in Multiplan, the court denied the company’s motion to dismiss, reasoning that the SPAC structure created a conflict between the sponsor and shareholders. Id. at *1. As before, the court found it conceivable that the sponsor was conflicted because it would receive a large return—20% of the post-IPO equity—even if the merger was bad for stockholders. Id. at *16. It further found the sponsor had an incentive to encourage stockholders not to redeem, because redemptions would decrease the merger’s likelihood of success and value to the sponsor. Id. Finally, the court rejected defendants’ argument that the stockholders’ favorable vote ratified the transaction, reasoning that their “voting interests were decoupled from their economic interests,” as the warrants would be worthless if no merger went through. Id. at *19.

After Delman, Delaware courts may review stockholder challenges to de-SPAC transactions under corporate law’s most onerous standard, entire fairness, which increases the chances that stockholder plaintiffs in such disputes will be entitled to discovery and potentially trial over the fairness of the transaction to the SPAC stockholders.

In a slightly different fact pattern, plaintiff in Laidlaw v. GigAcquisitions2, LLC, No. 2021-0821 (Del. Ch.) (“Gig2”), alleged that the failure to disclose was in relation to the financing structure of the de-SPAC transaction. The Gig2 plaintiff contended that defendants breached their fiduciary duty by omitting or intentionally burying in the proxy statement key details of the purported dilutive effect of the de-SPAC transaction on public stockholders’ shares. ECF No. 1 at 10. This omission and obfuscation, plaintiff alleged, impaired the public stockholders’ ability to make an informed decision on whether or not to exercise their redemption rights. Id. at 31. In this way, the plaintiff tried to analogize to In re Multiplan, asking the court to apply entire fairness. The Gig2 defendants countered that all the necessary disclosures regarding the dilutive effects of the transaction either could be found in the proxy statement or else could be gleaned by other information contained in the proxy. ECF No. 14 at 25. The defendants accused the plaintiff of making vague claims regarding the inadequacy of the disclosures in order to benefit from the In re MultiPlan decision. Id. at 2. In this way, the defendants attempted to distinguish this case from In re MultiPlan. The court’s decision on the defendants’ motion to dismiss is pending.

E. Delaware Supreme Court Cross-Designates Superior Court Judges To Help Reduce Court Of Chancery’s Workload

As the Court of Chancery’s workload has ballooned in recent years due to an expansion of its jurisdiction in 2016, Chief Justice Collins J. Seitz, Jr. sought to lighten the load by cross-designating certain Superior Court judges to preside over some Court of Chancery cases.

In February, the Chief Justice issued an order cross-designating five judges from the Superior Court’s sophisticated Complex Commercial Litigation Division (CCLD) to hear breach-of-contract cases filed in the Court of Chancery under Section 111 of the Delaware General Corporation Law. See In re Designation of Actions Filed Pursuant to 8 Del. C. § 111 (Feb. 23, 2023). Section 111 previously gave the Court of Chancery jurisdiction over stock sales by corporations, but in 2016, the Delaware General Assembly expanded that jurisdiction to include a broader range of transactions involving stock. H.B. 371, 148th Gen. Assemb. (Del. 2016).

Noting that “the Court[ of Chancery’s] ever-increasing caseload poses continued challenges,” the Chief Justice’s order will allow CCLD judges to hear Section 111 cases “for a trial period of one year.” Per the order, the Superior Court judges may sit in these cases when assigned by the Chancellor and President Judge of the Superior Court.

IV. Federal SPAC Litigation

In 2022, there were 102 closed de-SPAC transactions, a number that is almost half the 199 de-SPACs that closed in 2021. While the market for SPAC offerings has cooled relative to 2021, litigation arising out of SPAC transactions remains active.

Plaintiffs in In re CCIV/Lucid Motors Sec. Litig., 2023 WL 325251, at *4 (N.D. Cal. Jan. 11, 2023), are common stockholders of a SPAC called Churchill Capital Corporation IV (“CCIV”) who sued CCIV for alleged misrepresentations made by Lucid Motors—the company with which CCIV merged—prior to the de-SPAC transaction. Defendants filed a motion to dismiss on several grounds, including that plaintiffs lacked Section 10(b) standing. To that end, defendants asserted “that to have Section 10(b) standing, plaintiffs must allege the defendant made misrepresentations about the security actually purchased or sold by the plaintiffs.” Id. Defendants’ rule rested on “four bases:” “(i) consistency with Blue Chip [Stamps v. Manor Drug Stores, 421 U.S. 723 (1975)], (ii) precedence set by the Second Circuit, (iii) other supporting caselaw, and (iv) the need to construe the statute narrowly.” Id.

The courted rejected defendants’ standing rule but ultimately dismissed the complaint on materiality grounds. See id. at *11. With respect to defendants’ standing arguments, the court first concluded that Blue Chip did not “limit standing beyond the purchaser-seller rule”—i.e., that a party must be one or the other to have standing. See id. at *6. Next, the court distinguished the Second Circuit’s “two key decisions,” Ontario Public Service Employees Union Pension Trust Fund v. Nortel Networks Corporation, 369 F.3d 27 (2d Cir. 2004), and Menora Mivtachim Insurance Ltd. v. Frutarom Industries Ltd., 54 F.4th 82 (2d Cir. 2022), and declined defendants’ invitation to adopt the Second Circuit’s approach. See id. at *7 (noting the Second Circuit is “the only circuit court to address the standing issue at bar”). It found Blue Chip more instructive than Nortel and Nortel more “compelling” than Menora. Id. at *7-8. At bottom, the court concluded that although it could “appreciate the simplicity of the Nortel and Menora rule regarding standing,” the rule was “inconsistent with Supreme Court precedent and the policy considerations with respect to standing.” Id. at *9. The court also distinguished the cases defendants cited from outside the Second Circuit, noting, among other things, that several “appl[ied] Nortel with little or no commentary on the Second Circuit’s reasoning.” Id. at *8. Finally, the court disagreed that defendants’ rule was needed to comport with the requirement that Section 10(b) standing be construed “narrowly.” Id. at *9. Nonetheless, the court dismissed plaintiffs’ pleading on materiality grounds but gave plaintiffs an opportunity to amend. See Id. at *11.

V. ESG Civil Litigation

For the past several years, a growing number of lawsuits have been filed against public companies or their boards related to the companies’ environmental, social, and governance (“ESG”) disclosures and policies. These lawsuits can target a number of different ESG-related issues, and have had varying levels of success surviving past the pleading stage. While it may be too early to identify definitive trends in this area, this section surveys the types of ESG claims that are being filed and reports on notable decisions.

A. Greenwashing/Climate Change

Fagen v. Enviva Inc., No. 8:22-cv-02844 (D. Md. Nov. 3, 2022): In this action, plaintiffs alleged that Enviva misled investors by claiming to be an environmentally sustainable producer of wood pellets, while actually engaging in clear-cutting (which is a cheaper, but less sustainable, method of production). ECF No. 1 at 2–3. The complaint claims that Enviva made a number of statements about its sustainability performance in press releases, filings, and earnings calls, including that “sustainability remains the foundation of our business.” Id. at 5–21. In October 2022, an analyst published a report purporting to use geodata from Enviva disclosures to tie Enviva to clear-cutting. Id. at 22–23. The stock allegedly fell 13% on this news. Id. at 25. On February 2, 2023, the court approved the parties’ stipulated schedule, which provides that any motion to dismiss is due by June 2, 2023. ECF Nos. 28-29.

In re Danimer Scientific, Inc. Securities Litigation, No. 21-cv-02708 (E.D.N.Y. May 14, 2021): In this action, plaintiffs alleged that Danimer Scientific, Inc., a bioplastics company, misled investors by stating that its primary product was 100% biodegradable. ECF No. 44 at 2–3. When an article published in The Wall Street Journal claimed that the product’s ability to biodegrade was exaggerated, the company’s stock price allegedly dropped. Id. at 11–13. The motion to dismiss is fully briefed and pending before the court.

B. #MeToo/Workplace Harassment

Construction Laborers Pension Trust for Southern California v. CBS Corp., 433 F. Supp. 3d 515 (S.D.N.Y. 2020): In November 2022, the U.S. District Court for the Southern District of New York approved the settlement of a long-running putative securities fraud class action involving CBS. In this litigation, plaintiff alleged that CBS failed to disclose a “dark history of sexual misconduct,” concealed and fostered by its former CEO and chairman, that rendered statements about its code of ethics misleading. Id. at 525. In January 2020, the district court granted in part and denied in part a motion to dismiss the complaint. Id. at 552. The court recognized that “it is not the case that all statements in a code of conduct are categorically immaterial puffery” but held that the majority of statements contained in CBS’s ethics code were “far too general and aspirational to invite reasonable reliance.” Id. at 532–34. Still, the court held that plaintiff “adequately—though barely” alleged that a statement by CBS’s then-CEO regarding “[#MeToo] [being] a watershed moment” and it being “important that a company’s culture will not allow for this” was a misleading statement of material fact. Id. at 539. The court reasoned that “it is barely plausible that a reasonable investor would construe his statement as implicitly representing that he was just learning of problems with workplace sexual harassment . . . . even though, in truth, he was at that time actively seeking to conceal his own past sexual misconduct from CBS and the public.” Id. at 539–40. The parties settled the litigation for $14,750,000. ECF No. 226.

Cheng v. Activision Blizzard, Inc., No. 21-cv-6240, 2022 WL 2101919 (C.D. Cal. Apr. 18, 2022): In this action, plaintiffs alleged that Activision Blizzard, Inc. misled investors by making false or misleading statements about its workplace culture and failing to disclose employee misconduct despite two regulatory investigations that allegedly posed material risks to the company. The district court granted defendants’ motion to dismiss the complaint, holding that plaintiffs failed to sufficiently allege falsity and scienter. With respect to falsity, the district court held that Activision Blizzard had no duty to disclose the regulatory investigations prior to the government agency filing a complaint. Id. at *9. The court also held that the complaint’s confidential witness allegations regarding the “toxic” workplace lacked the specificity required under the PSLRA. Id. at *8. The court similarly held that plaintiffs’ allegation of scienter lacked “particularized facts” that defendants knew or should have known that the alleged misconduct was “endemic” at the company. Id. at *12. Although the court provided plaintiffs two opportunities to cure these deficiencies, the court continued to find that plaintiffs had not sufficiently alleged facts to support a finding of falsity or scienter and dismissed the third amended complaint with prejudice. ECF No. 98. Gibson Dunn represented an individual defendant in this matter.

C. Diversity And Inclusion

Ardalan v. Wells Fargo & Co., No. 22-cv-03811 (N.D. Cal. July 28, 2022): In this action, plaintiffs alleged that a bank announced an initiative requiring that fifty percent of interviewees be diverse for most U.S. roles above a certain salary threshold, and then purported to meet that requirement by conducting interviews for positions that had already been filled. ECF No. 1 at 2–3. These practices allegedly made the bank’s statements about its diversity initiatives materially misleading. Id. at 32–33. Plaintiffs alleged that the bank’s stock price fell by more than ten percent after a New York Times article purported to reveal the “fake” interviews. Id. at 6. The court appointed a lead plaintiff and set a schedule leading up to argument on a potential motion to dismiss on August 15, 2023. ECF No. 62 at 1.

EllieMaria Toronto ESA v. NortonLifeLock, No. 20-cv-05410, 2021 WL 3861434 (N.D. Cal. Aug. 30, 2021): In this derivative action, plaintiff alleged that although NortonLifeLock stated in its proxy statement that it was committed to diversity on its board, it never made a good-faith effort to recruit and nominate diverse directors. 2021 WL 3861434 at *1. Evaluating the proxy statements—which included statements like “the Board should reflect the benefits of diversity as to gender, race, and ethnic backgrounds”—the court held that “[c]ourts routinely find similar statements to be non-actionable puffery,” and dismissed the complaint. Id. at *1, *5–6. In October 2022, the Ninth Circuit affirmed the dismissal based on the district court’s alternative ruling that a valid forum-selection clause required the claim to be brought in Delaware. Esa ex rel. NortonLifeLock, Inc. v. NortonLifeLock, Inc., No. 21-16909, 2022 WL 14002189, at *1 (9th Cir. Oct. 24, 2022).

D. Anti-ESG Claims

City of St. Clair Shores Police and Fire Retirement System v. Unilever PLC, No. 22-cv-05011 (S.D.N.Y. June 15, 2022): In at least one action, investors challenged corporate commitments on ESG-related topics. This complaint arose from a Ben & Jerry’s board resolution purporting to end the sale of Ben & Jerry’s products in areas deemed “to be Palestinian territories illegally occupied by Israel.” ECF No. 1 at 6. Plaintiffs alleged that Ben & Jerry’s parent company made misleading statements to investors by failing to adequately disclose the business risks associated with the resolution. Id. at 10-18. Defendants filed a motion to dismiss on December 15, 2022, arguing that the parent company’s SEC filings “are too attenuated from the [r]esolution to impose any duty to disclose.” ECF 31 at 11. The motion to dismiss is pending.

* * * * *

Gibson Dunn will continue to monitor developments in ESG-related securities litigation. Additional resources regarding company disclosure decisions relating to ESG issues can be found on the insights page for Gibson Dunn’s ESG practice group.

VI. Lorenzo Disseminator Liability

In Lentell v. Merrill Lynch & Co., 396 F.3d 161, 177 (2d Cir. 2005), the Second Circuit held that “where the sole basis for [scheme liability] claims is alleged misrepresentations or omissions, plaintiffs have not made out a . . . claim under Rule 10b-5(a) and (c).” As discussed in our 2019 Mid-Year Securities Litigation Update, in Lorenzo v. SEC, the Supreme Court expanded scheme liability to encompass “those who do not ‘make’ statements” but nevertheless “disseminate false or misleading statements to potential investors with the intent to defraud.” 139 S. Ct. 1094, 1099 (2019). In the wake of Lorenzo, secondary actors—such as financial advisors and lawyers—could face scheme liability under Rules 10b-5(a) and 10b-5(c) simply for disseminating the alleged misstatement of another if a plaintiff can show that the secondary actor knew the alleged misstatement contained false or misleading information.

As we reported in a Client Alert, the Second Circuit ruled in SEC v. Rio Tinto that “Lentell remains vital” after Lorenzo, 41 F.4th 47, 53 (2d Cir. 2022), meaning that scheme liability still “requires something beyond misstatements and omissions.” Id. at 49. The Second Circuit emphasized that “misstatements or omissions were not the sole basis for scheme liability in Lorenzo. The dissemination of those misstatements was key.” Id. at 16 (emphasis added). Since our 2022 Mid-Year Securities Litigation Update, the reasoning of Rio Tinto has been applied a handful of times by district courts in the Second Circuit to dismiss scheme liability claims. Gibson Dunn represents Rio Tinto in this litigation and other litigation.

For example, in In re Turquoise Hill Resources Limited Securities Litigation, 2022 WL 4085677, at *7 (S.D.N.Y. Sept. 2, 2022), investors filed a putative class action alleging that Turquoise Hill, a majority-owned subsidiary of Rio Tinto, made false statements and omissions concerning the schedule and budget of a mining project. The district court held, in light of Rio Tinto, that plaintiffs could not establish scheme liability against Rio Tinto and its executives solely on the basis of Turquoise Hill’s misstatements or omissions where the investors did not allege that “anyone but Turquoise Hill itself published or distributed its own allegedly false and misleading statements.” Id. at *57. Further, the court concluded that the investors failed to allege other “underlying deceptive devices or frauds” by Rio Tinto that were distinct from the alleged false statements. Id. (quoting Rio Tinto, 41 F.4th at 55).

In SEC v. Stubos, 2022 WL 6776741, at *15-16 (S.D.N.Y. Oct. 11, 2022), the district court denied a motion to dismiss the SEC’s scheme liability claims after emphasizing that Rio Tinto did not hold that “dissemination” of a false statement is the only way to prove such claims. Rather, “dissemination is one example of something extra that makes a violation a scheme.” Id. (emphasis in original) (quoting Rio Tinto, 41 F.4th at 54). Accordingly, the district court held that the SEC’s scheme liability claims were adequately pleaded because the allegedly misleading disclosures made by stock promoters funded by defendant were “only one part of the many alleged deceptive actions” that defendant took, which allowed him to sell shares to unsuspecting investors in a purported pump-and-dump fraud scheme. Id.

These developments suggest that through the application of Lorenzo and now Rio Tinto, disseminator liability theory will continue to evolve. We will continue to monitor the changing applications of Lorenzo and provide a further update in our 2023 Mid-Year Securities Litigation Update.

VII. Survey Of Coronavirus-Related Securities Litigation

While governments around the U.S. and the world have largely lifted COVID-19 restrictions, coronavirus-related securities litigation continues to make its way through the U.S. courts. As we discussed in our 2022 Mid-Year Securities Litigation Update, many cases remain focused on misstatements concerning the efficacy of COVID-19 diagnostic tests, vaccinations, and treatments. We have also observed a growing number of cases involving false claims about pandemic and post-pandemic prospects. Many such cases are either moving into the motion-to-dismiss stage or have recently been dismissed, although a handful of new cases have also been filed.

Although the SEC was active in the beginning of 2022 in filing COVID-related actions (see below), we have seen a slowdown in the number of SEC-related COVID actions in the second half of last year.

Additional resources related to the impact of COVID-19 can be found in the Gibson Dunn Coronavirus (COVID-19) Resource Center.

A. Securities Class Actions

1. False Claims About COVID-19 Vaccinations, Treatments, And Testing

McDermid v. Inovio Pharms., Inc., No. 20-cv-01402, 2023 WL 227355 (E.D. Pa. Jan. 18, 2023): In our 2020 Mid-Year Securities Litigation Update, we reported that investors sued the biotechnology firm Inovio Pharmaceuticals in March 2020, alleging that the company and its executives made false and misleading statements regarding the progress of a COVID-19 vaccine, which artificially inflated Inovio’s stock. Id. at *1. After nearly three years of litigation, the case settled earlier this year, with Inovio agreeing to pay at least $44 million to the settlement class. Id. at *2.

Sanchez v. Decision Diagnostics Corp., No. 21-cv-00418, 2022 WL 18142518 (C.D. Cal. Dec. 5, 2022): In January 2021, plaintiffs filed suit against Decision Diagnostics Corp., alleging that the company “issued over one dozen materially false and/or misleading statements” regarding its purported newly developed COVID-19 testing device, including that it was on the verge of FDA approval. Id. at *1–4. In the spring of 2022, plaintiffs filed a motion for default judgment, seeking a total of $338,045 in damages. See id. at *5, 18. Decision Diagnostics filed an untimely answer in June 2022, and plaintiffs proffered their reply in July. Id. at *5; ECF Nos. 55-56. In December 2022, the court granted plaintiffs’ motion, awarding plaintiffs a total of $338,045 in damages. Sanchez v. Decision Diagnostics Corp., 2022 WL 18142518, at *18–19.

Sinnathurai v. Novavax, Inc., No. 21-cv-02910 (D. Md. Apr. 25, 2022): We first reported on this case in our 2021 Year End Securities Litigation Update. In this case, plaintiffs alleged that representatives of defendant Novavax made false and misleading statements by overstating the regulatory and commercial prospects for its vaccine, including by overstating its manufacturing capabilities and downplaying manufacturing issues that would impact the company when its COVID vaccine received regulatory approval. Id. at *13–16. On April 25, 2022, Novavax moved to dismiss the complaint, arguing that the alleged misstatements constituted nonactionable puffery and mere statements of opinion. See ECF No. 64-1 at 11–14. Novavax also argued that the PSLRA’s safe harbor—which immunizes from liability statements regarding “the plans and objectives of management for future operations” or “the assumptions underlying or relating” to those plans and objectives—insulates Novavax from liability as to certain challenged statements about the vaccine’s launch. Id. at 14. In addition, Novavax contended that the complaint does not adequately plead that certain statements about clinical trials and manufacturing issues were false or misleading. Id. at 17–23. In response, plaintiffs argued that the statements are actionable because Novavax touted its business (with statements such as “nearly all major challenges” had been overcome, and “all of the serious hurdles” were eliminated), but failed to disclose known facts contradicting those representations. ECF No. 65 at 11–12. Plaintiffs also disputed that certain statements were mere opinion, arguing that they were “virtually all flat assertions of fact that falsely assured investors that Novavax was ready to file its [emergency use authorization] quickly” and “had overcome the regulatory and manufacturing hurdles that had delayed that filing.” Id. at 19–20.

On December 12, 2022, the court granted in part and denied in part Novavax’s motion to dismiss. ECF No. 75. The court granted the motion with respect to eight of the ten at-issue statements and omissions. Id. The court denied the motion with respect to two statements in which the company’s CEO or CFO stated that the company had resolved its substantial production and supply chain issues, despite allegedly knowing that the company continued to face severe production obstacles, including a complete shutdown of one of its two manufacturing plants. Id. at 32–33. With respect to satisfying the scienter requirement for their claims, plaintiffs pointed to: (1) reports from confidential witnesses that the company was aware of facts rendering its statements false or misleading; (2) the FDA’s multiple warnings to the company that its manufacturing facilities and processes were not compliant with regulatory requirements; (3) the fact that the at-issue COVID-19 vaccine was critical to the company’s operations; and (4) defendants’ stock sales in advance of the relevant public disclosures. Id. at 38. The court conducted a holistic analysis of these factors and determined that they were sufficient to support an inference of scienter. Id. at 47–48.

2. Failure To Disclose Specific Risks

In re Talis Biomedical Corp. Sec. Litig., No. 22-cv-00105, 2022 WL 17551984 (N.D. Cal. Dec. 9, 2022): In this joint putative class action, plaintiffs alleged that Talis misled investors about the company’s COVID-19 test platform (“Talis One”) in its IPO and post-IPO filings, as well as during investor calls. Id. at *1. Among other things, plaintiffs challenged Talis’s statements regarding testing data submitted to the FDA and its manufacturing capability, as well as other statements related to the product’s purported reliability and safety. Id. at *9. The court dismissed the action in December, concluding that none of the statements were actionable, with most statements amounting to “vague corporate optimism and opinions.” Id. at *27–28. With regard to the alleged misstatement about Talis’s manufacturing capability (i.e., “we expect [to] scale to full capacity through 2021”), the court noted that plaintiffs failed “to sufficiently allege that the statements were false or misleading when made, and that absent any such allegations, the challenged statements would be protected by the bespeaks caution doctrine.” Id. at *14–15. The court further noted that such statements are protected by the PSLRA’s safe harbor provision as forward-looking statements, as defendants proffered cautionary language warning that “manufacturing lines ‘are not complete and could incur substantial delays . . . and may not perform as anticipated.’” Id. at *25. The court granted leave to amend the complaint, and plaintiffs filed a new amended complaint in January 2023. ECF No. 104.

Sharma v. Rent the Runway Inc. et al., No. 22-cv-6935, 2022 WL 16948257 (E.D.N.Y. Nov. 14, 2022): On November 14, 2022, plaintiffs filed a putative class action alleging that the e-commerce platform Rent the Runway made materially false and misleading statements and omissions in its October 2021 IPO offering documents. ECF No. 1 at 1, 6. While the company registration statement stated that COVID-19 had only minimal impact on its financial performance, even stating that the “COVID-19 pandemic has accelerated our consumer tailwinds,” plaintiffs alleged that Rent the Runway’s financials were significantly impacted by the pandemic. Id. at 5–6, 7.

Gutman v. Lizhi Inc., No. 21-cv-317, 2022 WL 4646471 (E.D.N.Y. Oct. 1, 2022): In January 2021, a putative class action was brought against the Chinese corporation Lizhi. ECF No. 1. The complaint alleged that Lizhi’s IPO registration statement and prospectus of January and April 2020, which stated that the company faced risks related to health epidemics, were materially false and misleading in light of the “direct and escalating exposure to the devasting coronavirus epidemic [] proliferating through China.” Id. at 9–10. The court granted Lizhi’s motion to dismiss, noting that plaintiffs failed to allege that COVID-19 was a known trend or uncertainty for Lizhi’s business. Gutman v. Lizhi Inc., 2022 WL 4646471, at *7. The court concluded that although plaintiffs’ allegations suggest that Lizhi might have known that COVID-19 existed, it did not know that the disease would spiral into a long-lasting global pandemic. Id. at *6–7.

3. False Claims About Pandemic And Post-Pandemic Prospects

City of Hollywood Police Officers’ Ret. Sys. v. Citrix Sys., Inc., No. 21-cv-62380 (S.D. Fla. Jan. 3, 2023): Citrix is a software company that provides digital workspaces to businesses. ECF No. 62 at 7. Plaintiffs in this case claimed that during the pandemic, Citrix hid numerous corporate problems and sold heavily discounted, short-term licenses that boosted its sales. Id. at 2–3. Plaintiffs alleged that the company’s transition to subscription licenses was not as successful as the company had disclosed, as customers failed to make the transition, instead preferring short-term on-premise licensing due to the COVID-19 pandemic. Id. Defendants moved to dismiss, claiming that the operative complaint inadequately alleged scienter and that the statements at issue were forward-looking statements, opinion, or puffery. ECF No. 68 at 2–3.

On January 3, 2023, the court granted defendants’ motion to dismiss in its entirety, relying on plaintiffs’ failure to sufficiently allege scienter on the part of any defendant. ECF No. 62 at 27. First, the court analyzed the individual defendants’ stock trades during the class period and determined that, on the whole, they did not give rise to an inference of scienter. Id. at 10–11. Specifically, the court agreed with defendants’ argument that stock sold during the class period pursuant to a Rule 10b5-1 trading plan cuts against any inference of scienter that could arise from defendants’ stock trades. Id. at 11. Furthermore, several defendants actually increased their net holdings of company stock during the class period, further negating any inference of scienter based on trading activity. Id. at 10. Second, the court determined that plaintiffs failed to allege that any defendants acted recklessly when making the at-issue statements; instead, these were general discussions of a business model transition that, with the benefit of hindsight, turned out to be inaccurate. Id. at 20–22.

In re Progenity, Inc., No. 20-cv-1683 (S.D. Cal. Jan. 13, 2023): We first reported on this case in our 2021 Year-End Securities Litigation Update. In this case, plaintiffs alleged that Progenity, a biotechnology company that develops testing products, made misleading statements and omitted material facts in its registration statement, including that Progenity failed to disclose that it had overbilled government payors and that it was experiencing negative trends in its testing volumes, selling prices, and revenues as a result of the COVID-19 pandemic. ECF No. 63 at 9. On September 1, 2021, the court dismissed the case with leave to file a second amended complaint, finding no actionable false or misleading statements. ECF No. 48. Plaintiffs then filed a second amended complaint on September 22, 2021. ECF No. 49. The company filed a second motion to dismiss on November 15, 2021, ECF No. 52, and the parties participated in a settlement conference in May 2022, ECF No. 58.

On January 13, 2023, the court granted defendants’ motion to dismiss the second amended complaint. ECF 63. The court determined that plaintiffs’ second amended complaint failed to sufficiently allege any material omission. See id. at 10–26. Several of the statements at-issue concerned the company’s sales decline as a result of the COVID-19 pandemic. See id. at 15, 21. The court determined that defendants’ statements regarding the impact of the pandemic on its sales volume were largely consistent with the reports of the confidential witnesses on which plaintiffs relied to inform their allegations. Id. at 19. Furthermore, the company was not obligated to disclose real-time sales volume data for periods after the company’s IPO but before its first 10-Q was due; instead, the company’s disclosures about a decline in sales at the time of the IPO were sufficient. See id. at 22. Gibson Dunn represents the company and its directors and officers in this litigation.

Weston v. DocuSign, Inc., No. 22-cv-00824 (N.D. Cal. July 8, 2022): Plaintiffs in this case alleged that DocuSign, a software company that enables users to electronically sign documents, made false and misleading statements that the “massive surge in customer demand” brought on by the pandemic was “sustained” and “not a short term thing.” ECF No. 59 at 2. Plaintiffs alleged that defendants knew that the demand was unsustainable after the pandemic subsided, and that defendants made corrective disclosures revealing that the company had missed billings-growth expectations after the initial surge of demand dissipated. Id. The court appointed a lead plaintiff on April 18, 2022, ECF No. 42, and plaintiffs filed the amended complaint on July 8, 2022, ECF No. 59. Defendants filed a motion to dismiss the complaint, arguing that the allegedly misleading statements are covered by the PSLRA’s safe harbor for forward-looking statements or are non-actionable statements of belief. ECF 68 at 11–16. Defendants also argued that plaintiffs failed to adequately allege scienter because the confidential witnesses on which plaintiffs rely to allege the individual defendants’ knowledge lack personal knowledge of the matter. Id. at 18. Defendants also objected to plaintiffs’ offer to provide the confidential witnesses’ employment details to the court in camera, as “plaintiffs may not sidestep [the PSLRA’s pleading standard] by providing necessary details to the court in camera.” Id. (citing Kipling v. Flex Ltd., 2020 WL 2793463, at *15 (N.D. Cal. May 29, 2020)). The court heard oral arguments on the motion on January 25, 2023. ECF 78.

4. Insider Trading And “Pump and Dump” Schemes

In re Eastman Kodak Co. Sec. Litig., No. 21-cv-6418, 2021 WL 3361162 (W.D.N.Y. Aug. 2, 2021): We have been following the consolidated cases captioned under the heading In re Eastman Kodak Company Securities Litigation since our 2020 Year-End Securities Litigation Update. Plaintiffs in this putative class action allege that Eastman Kodak and certain of its current and former directors and select current officers violated securities laws by failing to disclose that its officers were granted stock options prior to the company’s public announcement that it had received a loan from the United States International Development Finance Corporation (“DFC”) to produce drugs to treat COVID-19. ECF No. 116 at 2. On September 27, 2022, the court granted defendants’ motion to dismiss the complaint in its entirety. ECF 202. Analyzing the allegations in the complaint, the court determined that plaintiffs failed to adequately allege that defendants made misstatements or omissions of material fact in connection with the DFC loan. See id. at 29. In particular, the court determined that, as alleged, the several at-issue statements attributable to the company and its officers were nonactionable puffery and corporate optimism. Id. at 16. More specifically, plaintiffs failed to allege any facts indicating that Kodak’s CEO had actual knowledge that the DFC would ultimately decline to make the loan when he made public statements about his expectations for the company’s accomplishments with the DFC loan. Id. at 20–21. Furthermore, the court found that plaintiffs’ allegations regarding the improper grant of stock options to officers were purely conclusory and failed to provide an explanation for how the issuance of those options violated company policy. Id. at 28. Plaintiffs filed an appeal of the dismissal to the Second Circuit on October 27, 2022. ECF 204.

B. SEC Cases

SEC v. Berman, No. 20-cv-10658, 2021 WL 2895148 (S.D.N.Y. June 8, 2021): As previously reported, a federal grand jury indicted the CEO of Decision Diagnostics Corp. in December 2020 for allegedly attempting to defraud investors by making false and misleading statements about the development of a new COVID-19 rapid test. ECF No. 1 at 6–7. The CEO allegedly claimed the test was on the verge of FDA approval even though the test had not been developed beyond the conceptual stage. Id. at 6–7, 9. Shortly after the indictment in the criminal case, the SEC filed a civil enforcement action based on the same underlying facts against both Decision Diagnostics Corp. and its CEO. SEC v. Berman, 2021 WL 2895148, at *1. The SEC claims that defendants violated Section 10(b) of the Exchange Act and Rule 10b-5. SEC v. Berman, 2021 WL 2895148, at *1. The court stayed discovery in the civil case in June 2021 given the parallel criminal case against the CEO. Id. Discovery remains stayed, and the criminal trial is set for this coming July. See SEC v. Berman, No. 20-cv-10658 (S.D.N.Y. Nov. 28, 2022), ECF No. 32.

SEC v. SCWorx Corp., No. 22-cv-03287 (D.N.J. May 31, 2022): In the first half of 2022, the SEC filed a securities enforcement action against hospital supply chain SCWorx and its CEO, alleging that defendants falsely claimed in a press release to have a “committed purchase order” from a telehealth company for “two million COVID-19 tests” amounting to $840 million when the “committed purchase order” was, in reality, only a “preliminary summary draft.” ECF No. 1 at 2–3. In June 2022, SCWorx agreed to pay a penalty of $125,000 in addition to disgorgement of approximately $500,000. ECF No. 4 at 3. As reported in our 2022 Mid-Year Securities Litigation Update, SCWorx’s CEO was also indicted in a parallel criminal fraud case arising from the same allegations. ECF Nos. 20-21. With the CEO’s trial set for June 2023, the court stayed the SEC’s enforcement action until the conclusion of the criminal case. Id.

SEC v. Sure, No. 22-cv-01967 (N.D. Cal. Mar. 28, 2022): In March 2022, the SEC filed this civil enforcement action against a group of employees, as well as their friends and family members, at the cloud computing company Twilio. ECF No. 1. The SEC alleged that defendants violated Section 10(b) and Rule 10b-5 by engaging in insider trading in May 2020. Id. at 2. Specifically, the complaint states that certain defendant-employees informed other defendants about Twilio’s anticipated performance in advance of its May 6, 2020, earnings announcement, and that they unlawfully traded on that information. Id. at 8–9. As parallel criminal charges were also announced against one defendant, the court has stayed the case until July 31, 2023. ECF No. 31.

VIII. Falsity Of Opinions – Omnicare Update

In the nearly eight years since the Supreme Court issued its seminal decision concerning opinion statements in Omnicare, Inc. v. Laborers District Council Construction Industry Pension Fund, courts have regularly wrestled with “opinion” liability under the federal securities laws. That predictable trend continued in the second half of 2022. In Omnicare, the Supreme Court held that “a sincere statement of pure opinion is not an ‘untrue statement of material fact,’ regardless [of] whether an investor can ultimately prove the belief wrong,” but that an opinion statement can form the basis for liability in three different situations: (1) the speaker did not actually hold the belief professed; (2) the opinion contained embedded statements of untrue facts; or (3) the speaker omitted information whose omission made the statement misleading to a reasonable investor. 575 U.S. 175, 184–89 (2015). The second half of 2022 featured notable decisions by federal circuit courts, as well as further developments at the federal district court level.

A. Circuit Court Developments

1. Applications Of Omnicare Outside Of Section 11

As noted in prior updates, courts have regularly applied Omnicare, which was decided in the context of a Section 11 claim, to claims brought under the Exchange Act. Two recent decisions applying Omnicare provide additional examples. In Boykin v. K12, Inc., 54 F.4th 175 (4th Cir. 2022), the Fourth Circuit examined allegations that an educational technology company, K12, violated Section 10(b) and Rule 10b-5. Id. at 181. In affirming the district court’s dismissal, the Fourth Circuit explained that several of the at-issue statements “amount[ed] to opinions.” Id. at 183. Taking one example—”We believe we have attained distinctive core competencies that allow us to meet the varied needs of our school customers and students”—the court highlighted the fact that the statement included “the language ‘we believe’” and reflected an “individual perspective.” Id. at 184. Further, the court noted that plaintiffs had neither “seriously” challenged the truth of the “embedded assertion” of fact in the opinion nor denied that K12 actually believed it. Id. Finally, the court pointed to the context of the opinion statement, which—as highlighted in our 2021 Year-End Securities Litigation Update—is an additional factor courts consider in an Omnicare analysis. Id. In Boykin, the statement at issue was made in K12’s Form 10-K, a context that offered investors an opportunity to “parse[] the ample disclosures at their fingertips before succumbing to K12’s stated view.” Id.

In In re Finjan Holdings, Inc., — F.4th —, 2023 WL 329413 (9th Cir. Jan. 20, 2023), the Ninth Circuit examined allegations that a patent licensing and enforcement company and certain if its directors violated Section 14(e) of the Exchange Act in issuing revenue projections and share-value estimations to the company’s stockholders. The Ninth Circuit ultimately disagreed with the lower court’s analysis of scienter, but upheld the dismissal of the lawsuit based on its Omnicare analysis. The parties agreed that the challenged opinion statements could be actionable only “under a theory of subjective falsity.” Id. at *6. Thus, the court explained that plaintiff would need to “attack[] the basic factual assertion that underlies all statements of opinion: the assertion that the author holds and believes the stated opinion.” Id. However, the court continued, under Supreme Court and Ninth Circuit precedent, alleging subjective falsity alone would “not [be] enough to impose liability.” Id. Instead, plaintiff must also allege objective falsity. Id. at *6–7. After considering ten separate facts Plaintiff alleged to show subjective falsity, the Ninth Circuit concluded plaintiff’s complaint failed at the first step—i.e., it failed to plausibly allege subjective falsity because, for example, the price per share the company ultimately accepted was “the best final offer” the company received. Id. at *10–13.

2. Omnicare’s Intersection With Defamation Law And The First Amendment

The First Circuit recently confronted—but sidestepped—the question of whether its defamation caselaw applies in the securities fraud context. Defendant in SEC v. Lemelson, 57 F.4th 17, 22–23 (1st Cir. 2023) was tried by a jury and found liable for making false statements in violation of Section 10(b) and Rule 10b-5. After the verdict, Lemelson moved for judgment as a matter of law, arguing in relevant part that certain of the statements he made were non-actionable statements of opinion protected by the First Amendment. Id. at 23–25. Because the court concluded the at-issue statements were “statements of fact” rather than opinion, however, it declined Lemelson’s invitation to “decide whether the cases [he] cited . . . reach[ed] beyond defamation law.” Id. at 25. Nevertheless, the court continued, even if the cited cases did apply, Lemelson’s argument was unavailing because he was “claiming to be in possession of objectively verifiable facts,” and the at-issue statements “reasonably would be understood to declare or imply provable assertions of fact.” Id. at 24–25 (quoting McKee v. Cosby, 874 F.3d 54, 61 (1st Cir. 2017)). Although the Lemelson court declined to decide whether its defamation precedent applies in the securities fraud context, this remains a viable defense in certain situations, and we will continue to monitor developments in this area for other cases presenting better vehicles for federal court analysis and resolution.

B. District Court Developments

1. Fact v. Opinion: Categorical Approach

As noted in recent updates, federal courts in the wake of Omnicare have tended to accord certain categories of statements opinion status. See, e.g., 2021 Year-End Securities Litigation Update (“goodwill determinations”), 2020 Year-End Securities Litigation Update (“future predictions”), 2020 Mid-Year Securities Litigation Update (“statements of goals and belief”). Several cases in the back half of 2022 provide further examples of the types of statements that federal courts generally consider nonactionable opinions. For example, in Shash v. Biogen Inc., No. 21-cv-10479, 2022 WL 4134479, at *1 (D. Mass. Sept. 12, 2022), plaintiffs alleged that defendants made false or misleading statement concerning the efficacy of a potential Alzheimer’s drug, aducanumab. The court, however, concluded that the at-issue statements were nonactionable, in part, because they were opinions. Id. at *8, *15. The court explained that the Biogen “acknowledged that its conclusions” regarding the efficacy of aducanumab were “drawn from unprescribed post hoc analyses.” Id. at *8. And because “it is widely understood that unbounded post hoc analyses produce less reliable results,” Biogen’s conclusions were “more akin to opinions than conclusive findings.” Id. Indeed, the court noted, “[s]everal circuits have made explicit that ‘[i]nterpretations of clinical trial data are considered opinions’ and that disagreements with the scientific conclusions drawn from those opinions are not actionable.” Id. (quoting City of Edinburgh Council v. Pfizer, Inc., 754 F.3d 159, 170–71 (3d Cir. 2014)); see also Paxton v. Provention Bio, Inc., No. 21-cv-11613, 2022 WL 3098236, at *11–12 (D.N.J. Aug. 4, 2022) (concluding pharmaceutical company’s interpretation of a bridging study was a nonactionable opinion).

In In re Turquoise Hill Resources Limited Securities Litigation, No. 20-cv-08585, 2022 WL 4085677, at *30 (S.D.N.Y. Sept. 2, 2022), plaintiffs alleged that defendants’ statement that “these types of delays are certainly not atypical in the mining industry for projects of this scale and complexity” was false or misleading. In plaintiffs’ view, Omnicare held that a “statement is an opinion only when it is expressly stated as such,” and defendants’ statement was therefore one of fact. Id. at *31. The court rejected plaintiffs’ “simplistic[]” view of Omnicare and explained the case said no such thing. Id. In fact, the court continued, “[e]stimates, in particular, constitute a well-established species of opinion.” Id. (quoting Martin v. Quartermain, 732 F. App’x 37, 40 & n.1 (2d Cir. 2018)). Thus, the court concluded, “[f]or the same reasons that estimates are well-established species of opinion, the statement in isolation that delays were ‘not atypical’ is one of opinion”—”[i]t cannot be decided as a ‘matter[ ] of objective fact.’” Id. (quoting Fait v. Regions Fin. Corp., 655 F.3d 105, 110 (2d Cir. 2011)).

2. Possession Of Contrary Facts

In addition to addressing categories of generally nonactionable statements in the second half of 2022, federal district courts also analyzed circumstances in which defendants allegedly possessed facts that undermined the bases for the their opinions. For example, in In re Boston Scientific Corporation Securities Litigation, No. 20-cv-12225, 2022 WL 17823837, at *21 (D. Mass. Dec. 20, 2022), a medical device manufacturer allegedly represented that a medical device “was driving growth” and that a “dual-valve strategy made sense for the company.” The court rejected defendants’ argument that the statements were nonactionable opinions because the “statements ‘could be reasonably construed in context as a statement of fact,’ such that ‘it would be false as compared to the complaint’s contention that’” the company’s “leadership had either already decided [the device] was unsalvageable or was on the cusp of doing so in a matter of weeks.” Id. (quoting Constr. Indus. and Laborers Joint Pension Tr. v. Carbonite, Inc., 22 F.4th 1, 7 (1st Cir. 2021)). Similarly, in Kusnier v. Virgin Galactic Holdings, Inc., No. 21-cv-03070, 2022 WL 16745512, at *9 (E.D.N.Y. Nov. 7, 2022), plaintiffs asserted that a space flight company’s statements were misleading given the information known to the company at the time. Over defendants’ objection that the statements were nonactionable opinions, the court held the statements were actionable and explained that “even an ‘optimistic projection[ ] of future performance’ may be actionable’” “[w]here an ‘opinion [is] without a basis in fact or the speakers [are] aware of facts undermining the positive statements.’” Id. (quoting In re Nokia Oyj (Nokia Corp.) Sec. Litig., 423 F. Supp. 2d 364, 397 (S.D.N.Y. 2006)).